By going through these CBSE Class 12 Accountancy Notes Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner, students can recall all the concepts quickly.

Reconstitution of Partnership Firm: Admission of a Partner Notes Class 12 Accountancy Chapter 3

As we know that Partnership is an agreement between the partners or members of the firm for sharing profits and losses of the business carried on by all or any of them acting for all. Any change in this agreement amounts to the reconstitution of the partnership firm.

A change in the agreement brings to an end the existing agreement and a new agreement comes into existence. This new agreement changes the relationship among the members or partners of the partnership firm. Hence, whenever there is a change in the partnership agreement, the firm continues but it amounts to the reconstitution of the partnership firm.

Modes of Reconstitution of the Partnership Firm:

Reconstitution of partnership firm usually takes place in any of the following situations:

- At the time of admission of a new partner;

- Change in the profit-sharing ratio of existing partners;

- At the time of retirement of an existing partner;

- At the time of death of a partner;

- The amalgamation of two partnership firms.

Admission of a New Partner:

When a business enterprise requires additional capital or managerial help or both for the growth and expansion of the business it may admit a new partner to supplement its existing resources. So, admission of a new partner is required for the following reasons:

- Requirement of more capital for the expansion of the business.

- Need of a competent and experienced person for the efficient running of the business.

- To increase the goodwill of the business by taking a reputed and renowned person into the partnership.

- To encourage a capable employee by taking him into the partnership.

According to Sec. 31, Indian Partnership Act, 1932, a new partner can be admitted into the firm only with the consent of all the existing partners unless otherwise agreed upon. Admission of a new partner means reconstitution of the firm. It is so because the existing agreement comes to an end and a new agreement comes into effect.

A newly admitted partner acquire s two main rights in the firm:

- Right to share m the assets of the partnership firm, and

- Right to share in the profits of the partnership firm.

Section 31, Indian Partnership Act, 1932, further specifies that the new partner is not liable for any debts incurred by the firm before he became a partner. New partner, however, will become liable if:

- the reconstituted firm assumes the liabilities to pay the debt; and

- the creditors have agreed to accept the reconstituted firm as their debtors and discharge the old firm from liability.

A new partner brings an agreed amount of capital either in cash or in-kind and he also contributes some additional amount known as premium or goodwill. This is done primarily to compensate the existing partners for the loss of their share in the profits of the firms.

Adjustment at the Time of Admission of a New Partner:

- New profit sharing ratio;

- Sacrificing ratio;

- Valuation and adjustment of goodwill;

- Revaluation of assets and liabilities;

- Distribution of accumulated profits or losses or reserves; and

- Adjustment of partners capitals.

New Profit Sharing Ratio:

The ratio in which all partners including new partner share the future profits is called the new profit sharing ratio. In other words, on the admission of a new partner, the old partners sacrifice a share of their profits in favour of the new partner. On admission of a new partner, the profit-sharing ratio among the old partners will change keeping in view their respective contribution to the profit-sharing ratio of the incoming partner. Hence, there is a need to ascertain the new profit sharing ratio among all the partners.

The new partner may acquire his share from the old partners in any of the following situations:

1. If only the ratio of the new partner is given, then in the absence of any other agreement or information, it is assumed that the old partners will continue to share the remaining profits in the old ratio.

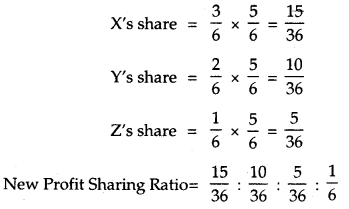

Example: X, Y.and Z are partners sharing profits in the ratio 3:2:1 respectively. A is admitted in the firm as a new partner with \(\frac{1}{6}\)th share. Find the new profit sharing ratio.

Answer:

Let total profit = 1

A’s share = \(\frac{1}{6}\)th

Remaining Profit = 1 – \(\frac{1}{6}\) = \(\frac{5}{6}\)

Old partners share this remaining profit in the old profit sharing

= \(\frac{15: 10: 5: 6}{36}\)

= 15: 10: 5: 6

2. If the new partner acquires his share of profit from the old partners equally. In that case, the new profit sharing ratio of the old partner will be calculated by deducting the sacrifice made by them from their existing share of profit.

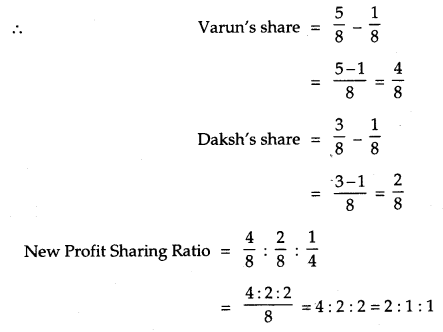

Example: Varun and Daksh are partners sharing profits and losses in the ratio 5:3. They admit Dhruv as a partner for \(\frac{1}{4}\)th share, which he acquires equally from Varun and Daksh. Calculate the new profit sharing ratio.

Answer:

Dhruv1s share = \(\frac{1}{4}\)

Share acquired by Dhruv from Varun = \(\frac{1}{4} \times \frac{1}{2}=\frac{1}{8}\)

Share acquired by Dhruv from Daksh = \(\frac{1}{4} \times \frac{1}{2}=\frac{1}{8}\)

3. In the new partner acquire his share of profit from the old partners in a particular ratio. In that case, the new profit sharing ratio of the old partners will be calculated by deducting the sacrifice made by them from their existing share of profit.

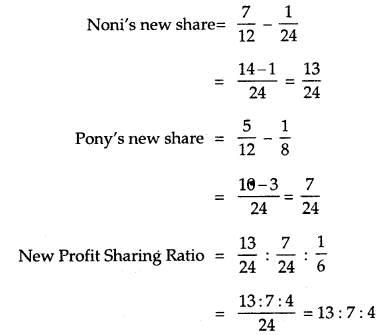

Example: Noni and Pony are partners, sharing profits in the ratio of 7:5. They admit Tony as new partner for \(\frac{1}{6}\)th share which he takes \(\frac{1}{24}\)th from Noni and \(\frac{1}{8}\)th from Pony. Calculate the new profit sharing ratio.

Answer:

4. If the old partners surrender a particular fraction of their share in favour of the new partner. In that case, the new partner’s share is calculated by adding the surrendered portion of the share by the old partners. Old partners’ share is calculated by deducting the surrendered portion from their old ratio.

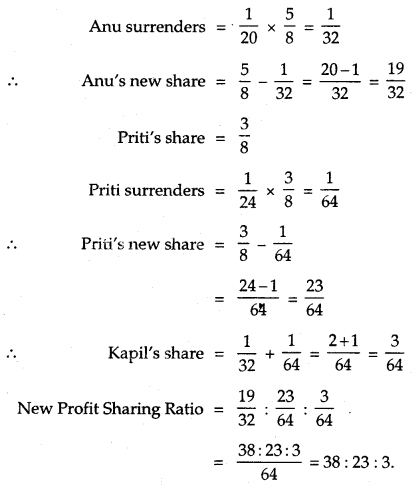

Example: Anu and Priti are partners in firm sharing profits in the ratio of 5:3. Anu surrenders \(\frac{1}{20}\)th of her share and Priti surrenders \(\frac{1}{24}\)th of her share in favour of Kapil, a new partner. Calculate the new profit sharing ratio.

Answer:

Anu’s share = \(\frac{5}{8}\)

5. If the new partner acquires his share of profit from only one partner. In that case, the new profit sharing ratio of the old partner will be calculated by deducting the sacrifice made by one partner from his existing ratio.

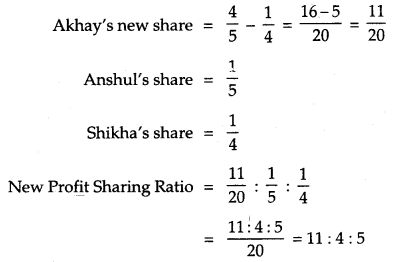

Example: Akshay and Anshul are partners in a firm sharing profits in a 4: 1 ratio. They admitted Shikha as a new partner for \(\frac{1}{4}\) share in the profits, which she acquired wholly from Akshay. Calculate the new profit sharing ratio.

Answer:

Akhay’s share = \(\frac{4}{5}\)

Sacrificing Ratio:

The ratio in which the old partners have agreed to sacrifice their shares in profit in favour of a new partner is called the sacrificing ratio. This ratio is calculated by taking out the difference between the old profit sharing ratio and the new profit sharing ratio.

Sacrificing Ratio = Old Ratio – New Ratio

Goodwill:

Goodwill is the value of the reputation of a firm in respect of the profits expected in future over and above the normal profits earned by other similar firms belonging to the same industry. In other words, a well-established business develops an advantage of good name, reputation and wide business connections. This helps the business to earn more profits as compared to newly set-up business. This advantage in monetary terms called ‘Goodwill’. It arises only if a firm is able to earn higher profits than normal.

“Goodwill is nothing more than the probability that old customers will resort to the old place.” – Lord Eldon

“The term goodwill is generally used to denote the benefit arising from connections and reputation.” -Lord Lindley

“Goodwill is a thing very easy to describe, very difficult to define. It is the benefit and advantage of the good name, reputation and connections of a business. It is the attractive force that brings in customers. It is one thing which distinguishes an old-established business from a new business at its first start.” -Lord Macnaghten

“Goodwill may be said to be that element arising from the reputation, connections or other advantages possessed by a business which enable it to earn greater profits than the return normally to be expected on the capital represented by the net tangible assets employed in the business.” – Spicer and Pegler

“When a man pays for goodwill, he pays for something which places him in the position of being able to earn more than he would be able to do by his own unaided efforts.” -Dicksee

Thus, goodwill can be defined as “the present value of a firm’s anticipated excess earnings “or as” the capitalised value attached to the differential profits capacity of a business.”

Characteristics of Goodwill:

- Goodwill is an intangible asset but not a fictitious asset;

- It is a valuable asset. Its value is dependent on the subjective judgement of the valuer.

- It helps in earning higher profits than normal.

- It is very difficult to place an exact value on goodwill. It is fluctuating from time to time due to changing circumstances of the business.

- Goodwill is an attractive force that brings in customers to the old place of business.

- Goodwill comes into existence due to various factors.

Factors Affecting the Value of Goodwill:

1. Nature of business: Company produces high value-added products or having stable demand in the market. Such a company will have more goodwill and is able to earn more profits.

2. Location: If a business is located in a favourable place, it will attract more customers and therefore will have more goodwill.

3. Efficient Management: Efficient Management brings high productivity and cost efficiency to the business which enables it to earn higher profits and thus more goodwill.

4. Market Situation: A firm under monopoly or limited competition enjoys high profits which leads to a higher value of goodwill.

5. Special Advantages: A firm enjoys a higher value of goodwill if it has special advantages like import licences, low rate and assured supply of power, long-term contracts for sale and for purchase, patents, trademarks etc.

6. Quality of Products: If the quality of products of the firm is good and regular, then it has more goodwill.

Need for Valuation of Goodwill:

- At the time of sale of a business;

- Change in the profit-sharing ratio amongst the existing partners;

- Admission of a new partner.

- Retirement of a partner;

- Death of a partner;

- Dissolution of a firm;

- The amalgamation of the partnership firm.

Methods of Valuation of Goodwill:

Goodwill is an intangible asset, so it is very difficult to calculate its exact value. There are various methods for the valuation of goodwill in the partnership, but the value of goodwill may differ in different methods. The method by which the value of goodwill is to be calculated may be specifically decided among all the partners.

The methods followed for valuing goodwill are:

- Average Profit Method

- Super Profit Method

- Capitalisation Method.

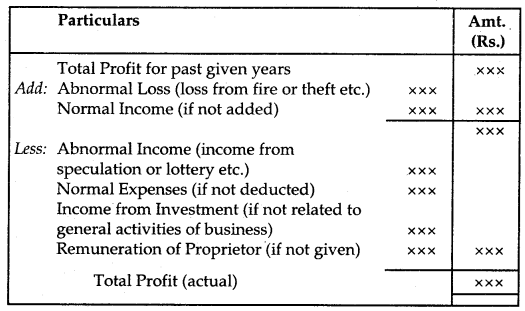

1. Average Profit Method:

Goodwill is calculated on the basis of the number of past years profits. In this method, the goodwill is valued at an agreed number of ‘years’ purchase of the average profits of the past few years.

Steps:

- Find the total profit of the past given years.

- Add ail Abnormal Losses like loss from fire or theft etc. and any Normal Income if not added before to the total profit of past given year.

- Then, subtract, Abnormal Income (income from speculation or lottery etc.), Normal Expenses (if not deducted), Income from investment (if not related to general activities of business) and remuneration of the proprietor (if not given), if any, from the total profit of past given years.

- After this, calculate the actual average profit by dividing the total profit by a number of years.

- Then multiply Average Profit by the numbers of year purchases to find out the value of goodwill.

In other words:

Actual Average Profit = \(\frac{\text { Total Profit }}{\text { No. of Years }}\)

Goodwill = Actual Average Profit × No. of Years Purchased

→ Weighted Average Profit Method

Sometimes, if there exists an increasing or decreasing trend, it is considered to be better to give a higher weightage to the profits to the recent years than those of the earlier years. This method is an extension of the average profit method.

Steps:

- Multiply each year’s profit to the weights assigned to each year respectively.

- Find the total of the product.

- Divide this product by total weights for ascertaining average profits.

- Average profits then multiplied with No. of years purchased to find the value of Goodwill.

2. Super Profit Method:

Under this method, goodwill is valued on the basis of excess profits earned by a firm in comparison to average profits earned by other firms. When a similar type of firm gets a return as a certain percentage of the capital employed, it is called ‘normal return’. The excess of actual profit over the normal profit is called ‘Super Profits’. To find out the value of goodwill, Super profit is multiplied by the agreed number of year’s purchase.

Steps:

- Calculate Actual Average Profit i.e. \(\left[\frac{\text { Total Profit }}{\text { No. of Years }}\right]\)

- Calculate Normal Profit i.e.

= \(\text { Capital Employed } \times \frac{\text { NormalRate of Return }}{100}\)

[Capital Employed = Total Assets – Outside Liabilities] - Find Out Super Profits

Super Profits = Actual Average Profit – Normal Profit - Calculate the Value of Goodwill

= Super profit × No. of years purchased

3. Capitalisation Methods:

(a) by capitalizing the average profits

(b) by capitalizing the super profits.

(a) Capitalisation of Actual Average Profit Method:

Steps:

- Calculate actual average profit: \(\left[\frac{\text { Total Profit }}{\text { No. of Years }}\right]\)

- Capitalize the average profit on the basis of the normal rate of return:

The capitalised value of actual average profit

= Actual Average Profit × \(\frac{100}{\text { Normal Rate of Return }}\) - Find out the actual capital employed:

Actual Capital Employed = Total Assets at their current value other than [Goodwill, Fictitious assets and non-trade investments] – Outside Liabilities. - Compute the value of Goodwill:

Goodwill = Capitalised value of actual average profit – Actual Capital Employed.

(b) Capitalisation of Super Profit Method:

Steps:

- Calculate Actual Capital Employed [same as above].

- Calculate Super Profit [same as under Super Profit Method].

- Multiply the Super Profit by the required rate of return multiplier:

Goodwill = Super Profit × \(\frac{100}{\text { Normal Rate of Return }}\)

Treatment of Goodwill:

To compensate old partners for the loss (sacrifice) of their share in profits, the incoming partner, who acquire his share of profit from the old partners brings in some additional amount termed as a share of goodwill.

Goodwill, at the time of admission, can be treated in two ways:

- Premium Method

- Revaluation Method.

1. Premium Method:

The premium method is followed when the incoming partner pays his share of goodwill in cash. From the accounting point of view, the following are the different situations related to the treatment of goodwill:

(a) Goodwill (Premium) paid privately (directly to old partners)

[No entry is required]

(b) Goodwill (Premium) brought in cash through the firm

1. Cash A/c or Bank A/c Dr.

To Goodwill A/c

(For the amount of Goodwill brought by new partner)

2. Goodwill A/c Dr.

To Old Partner’s Capital A/c

(For the amount of Goodwill distributed among the old partners in their sacrificing ratio)

Alternatively:

1. Cash A/c or Bank A/c Dr.

To New Partner’s Capital A/c (For the amount of Goodwill brought b> a new partner)

2. New Partner’s Capital A/c Dr.

To Old Partner’s Capital A/c’s (For the amount of Goodwill distributed among the old partners in their sacrificing ratio)

3. If old partners withdrew goodwill (in full or in part) (if any)

Old Partner’s Capital A/c’s Dr.

To Cash A/c or Bank A/c

(For the amount of goodwill withdrawn by the old partners)

When goodwill already exists in books:

If the goodwill already exists in the books of firms and the incoming partner brings his share of goodwill in cash, then the goodwill appearing in the books will have to be written off.

Old Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For Goodwill written-off in old ratio)

After the admission of the partner, all partners may decide to maintain the Goodwill Account in the books of accounts.

Goodwill A/c Dr.

To All Partner’s Capital A/c’s (For Goodwill raised in the new firm after admission of a new partner in new profit sharing ratio)

2. Revaluation Method:

If the incoming partner does not bring in his share of goodwill in cash, then this method is followed. In this case, the goodwill account is raised in the books of accounts. When goodwill account is to be raised in the books there are two possibilities:

(a) No goodwill appears in books at the time of admission.

(b) Goodwill already exists in books at the time of admission,

(a) No goodwill appears in the books:

Goodwill A/c Dr.

To Old Partner’s Capital A/c’s (For Goodwill raised at full value in the old ratio)

If the incoming partner brings in a part of his share of goodwill. In that case, after distributing the amount brought in for goodwill among the old partners in their sacrificing ratio, the goodwill account is raised in the books of accounts based on the portion of premium not brought by the incoming partner.

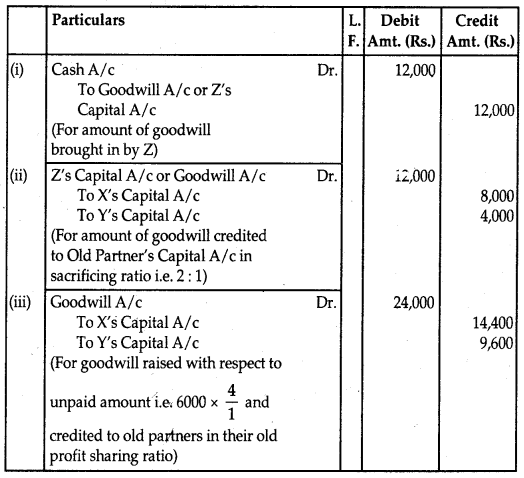

Example: X and Y are partners sharing profits in the ratio of 3: 2.

They admit Z as a new partner. \(\frac{1}{4}\)th share. The sacrificing ratio of X and Y is 2: 1. Z brings Rs. 12,000 as goodwill out of his share of Rs. 18,000. No goodwill account appears in the books of the firm.

Answer: Journal

(b) When goodwill already exists in the books

1. When the value of goodwill appearing in books is equal to the agreed value:

[No Entry is Required]

2. If the value of goodwill appearing in the books is less than the agreed value:

Goodwill A/c Dr.

To Old Partner’s Capital A/c’s (For Goodwill is raised to its agreed value)

3. If the value of goodwill appearing in the books is more than the agreed value:

Old Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For Goodwill brought down to its agreed value)

→ If partners, after raising Goodwill in the books and making necessary adjustments decide that the goodwill should not appear in the firm’s balance sheet, then it has to be written off.

All Partners’ Capital A/c’s Dr.

To Goodwill A/c (For Goodwill written off)

→ Sometimes, the partners may decide not to show goodwill account anywhere in books.

New Partner’s Capital A/c Dr.

To Old Partner’s Capital A/c (For adjustment for New Partner’s Share of Goodwill)

Hidden or Inferred Goodwill:

1. To find out the total capital of the firm by new partner’s capital and his share of profit.

Example: New partner’s capital for \(\frac{1}{4}\)th share is Rs. 80,000, the entire capital of the new firm will be

80,000 × \(\frac{4}{1}\) = Rs. 3,20,000

2. To ascertain the existing total capital of the firm: We will have to ascertain the existing total capital of the new firm by adding the capital (of all partners, including new partner’s capital after adjustments, if any excluding goodwill)

→ If assets and liabilities are given:

Capital = Assets (at revalued figures) – Liabilities (at revalued figures)

3. Goodwill = Capital from (1) – Capital from (2)

Generally, this method is used, when the incoming partner does not bring his share of goodwill in cash. Here, we find out the total goodwill of the firm. After that, we can find out the new partner’s share of goodwill and treat accordingly.

Adjustment for Accumulated (Undistributed) Profits and Losses:

1. For Undistributed Profits, Reserves etc.

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

General Reserves A/c Dr.

Reserve fund A/c Dr.

Profit and Loss A/c Dr.

Workmen’s Compensation Fund A/c Dr.

To Old Partner’s Capital A/c’s

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

2. For Undistributed Losses:

Old Partner’s Capital A/c’s Dr.

To Profit and Loss A/c

(For distribution of accumulated losses to old partners in old profit sharing ratio)

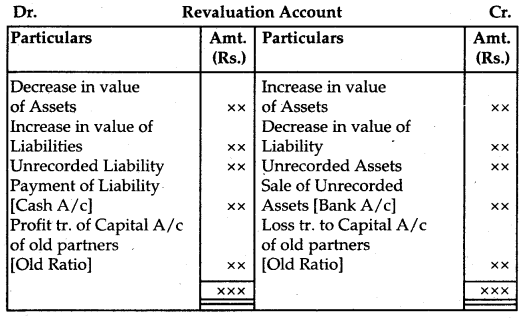

Revaluation of Assets and Reassessment of Liabilities: Revaluation of Assets and Reassessment of Liabilities is done with the help of ‘Revaluation Account’ or ‘Profit and Loss Adjustment Account’.

The journal entries recorded for revaluation of assets and reassessment of liabilities are following:

1. For increase in the value of an Assets

Assets A/c Dr.

To Revaluation A/c (Gain)

2. For decrease in the value of an Assets

Revaluation A/c Dr.

To Assets A/c (Loss)

3. For appreciation in the amount of Liability

Revaluation A/c Dr.

To Liability A/c (Loss)

4. For reduction in the amount of a Liability

Liability A/c Dr.

To Revaluation A/c (Gain)

5. For recording an unrecorded Assets

Unrecorded Assets A/c Dr.

To Revaluation A/c (Gain)

6. For recording an unrecorded Liability

Revaluation A/c Dr.

To Unrecorded Liability A/c (Loss)

7. For the sale of unrecorded Assets

Cash A/c or Bank A/c Dr.

To Revaluation A/c (Gain)

8. For payment of unrecorded Liability

Revaluation A/c Dr.

To Cash A/c or Bank A/c (Loss)

9. For transfer of gain on Revaluation if the credit balance

Revaluation A/c Dr.

To Old Partner’s Capital A/c’s (Old Ratio)

10. For transfer of loss on Revaluation if debit balance

Old Partner’s Capital A/c’s Dr.

To Revaluation A/c (Old Ratio)

Adjustment of Capitals:

1. When the new partner brings in proportionate capital OR On the basis of the old partner’s capital.

(a) Calculate the adjusted capital of old partners (after all adjustments)

(b) Total capital of the firm

= Combined Adjusted Capital × Reciprocal proportion of the share of old partners

(c) New Partner’s Capital

= Total Capital × Proportion of share of a new partner.

2. On the basis of the new partner’s capital:

(a) Total Capital of the firm = New Partner’s Capital × Reciprocal proportion of his share.

(b) Distribute Total Capital in New Profit Sharing Ratio.

(c) Calculate adjusted capital of old partners.

(d) Calculate the difference between New Capital and Adjusted Capital.

- If the debit side of the Capital Account is bigger then it means he has excess capital

Partner’s ( capital Accounts Dr.

To Cash A /c or Bank A/c or Current A/c - If the credit side is bigger then it means that he has short capital

Cash A/c or Bank A/c or Current A/c Dr.

To Partner’s Capital A/cs

Change in Profit Sharing Ratio among the Existing Partners:

Sometimes the existing partners of the firm may decide to change their profit sharing ratio. In such a case, some partner will gain in future profits and some will lose. Here the gaining partners should compensate the losing partners unless otherwise agreed upon. In such a situation, first of all, the loss and gain in the value of goodwill (if any) will have to adjust.

1. Goodwill A/c Dr.

To Partner’s Capital A/c’s (For raising the amount of Goodwill in old ratio)

2. Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For writing off the amount of Goodwill in New Profit sharing ratio)

Alternatively:

Gaining Partner’s Capital A/c’s Dr.

To Losing Partner’s Capital A/c’s (For adjustment due to change in profit sharing ratio)