By going through these CBSE Class 12 Accountancy Notes Chapter 5 Dissolution of a Partnership Firm, students can recall all the concepts quickly.

Dissolution of a Partnership Firm Notes Class 12 Accountancy Chapter 5

The word Dissolution implies “the undoing or breaking of a bond tie”. In other words, dissolution implies that the existing state of arrangement is done away with. In terms of the partnership, dissolution means discontinuance of relationships amongst the partners.

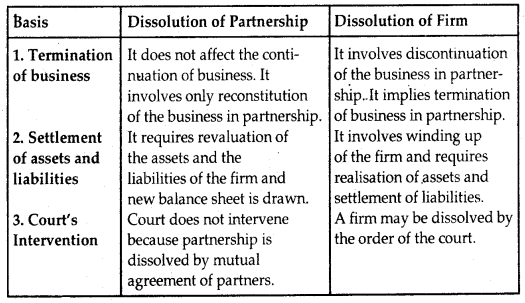

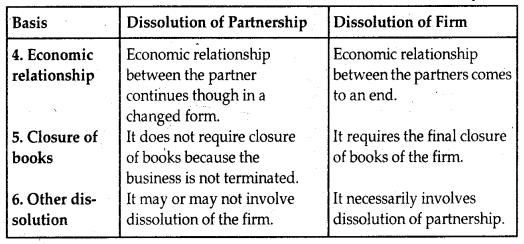

But the dissolution of partnership and dissolution of a partnership firm are two different terms. As we know that the reconstitution of a partnership firm takes place on account of admission, retirement, or death of a partner. Here, the existing partnership is dissolved, but the firm may continue under the same name if the partners so decide. It means that it results in the dissolution of a partnership but not that of the firm.

The dissolution of a partnership does not lead to the dissolution of the firm since the two situations are different. In case of dissolution of the partnership, the firm continues, only the partnership relation is reconstituted, but in case of dissolution of the firm, not only partnership is dissolved but the firm also loses its existence, implying thereby that the firm ceases to operate as a partnership firm.

Dissolution of a Partnership:

If dissolution involves only the reconstitution of the firm and the business in partnership is continued in the same name after the dissolution of the partnership agreement, it is known as the ‘Dissolution of the Partnership’. It involves a change in the relationship between partners without affecting the continuity of business. Here, the firm is reconstituted without the dissolution of the Finn.

A partnership is dissolved by change of mutual contract in the following cases:

- Change in the existing profit sharing ratio among partners.

- Admission of a new partner.

- Retirement of a partner.

- Death of a partner (Section 42).

- Insolvency of a partner.

- Completion of the venture if the partnership is formed for that,

- Expiry of the period of the partnership, if the partnership is for a specific period.

- The merger of one partnership firm into another.

Dissolution of a Firm:

According to Section 39 of the Indian Partnership Act, 1932 dissolution of a partnership between all the partners of a firm is called the ‘dissolution of the firm’.

It refers to the winding up of the business in partnership. It involves a complete breakdown of relations among all the partners and is the dissolution of a partnership between all the partners of a firm. Here, in this situation, business is to be discontinued, it requires the realization of assets and settlement of liabilities.

Dissolution of a firm takes place in the following cases:

Dissolution by Agreement

- All the partners give consent to it; or

- As per the terms of the partnership agreement.

Compulsory Dissolution:

- Where all the partners or all expect one partner, become insolvent or insane rendering them incompetent to sign a contract; or

- When the business of the firm becomes illegal; or

- When some event has taken place which makes it unlawful for the partner to catty on the business of the firm in partnership.

On the Happening of Certain Contingencies

Subject to contract between the partners, a firm is dissolved:

- if constituted for a fixed term, by the expiry of that term; or

- if constituted to carry out one or more ventures, by the completion thereof; or

- where all the partners except one decided to retire from the firm; or

- where all the partners or all except one partner dies; or

- by the adjudication of a partner as an insolvent.

Dissolution by Notice:

In case of partnership at will, the firm may be dissolved if any of the partners give notice in writing to the other partners signifying his intention of seeking dissolution of the firm.

Dissolution by Court (Under Section 44):

At the suit of a partner, the court may order for dissolution of partnership firm on any of the following grounds:

- If a partner becomes insane; or

- When a partner becomes permanently incapable of performing his duties as a partner; or

- When a partner is guilty of misconduct that is likely to adversely affect the business of the firm; or

- When a partner deliberately and consistently commits a breach of agreements relating to the management of the firm; or

- When the partner transfer whole of his interest in the firm to a third party; or

- When the business of the firm cannot be carried on, except at a loss; or

- When the court, on any ground, regards dissolution to be just and equitable.

Difference between Dissolution of Partnership and Dissolution of Firm:

Settlement of Accounts

In case of dissolution of a firm, the firm ceases to conduct business and has to settle its accounts. For this purpose, it disposes of all its assets for satisfying all the claims against it. Section 48 of the Partnership Act provides the following rules for the settlement of accounts between the partners:

(a) Treatment of Losses

Losses, including deficiencies of capital, shall be paid:

- first out of profits,

- next out of the capital of partners, and

- lastly, if necessary, by the partners individually in their profits sharing ratio.

(b) Application of Assets

The assets of the firm, including any sum contributed by the partners to make up deficiencies’ of Capital, shall be applied in the following manner and order:

- In paying the debts of the firm to the third parties;

- In paying each partner proportionately what is due to him/ her from the firm for advances as distinguished from capital (i.e. partner’s loan);

- In paying to each partner proportionately what is due to him on account of capital; and

- The residue, if any, shall be divided among the partners in their profit-sharing ratio.

Thus, assets realized along with a contribution from the partner if required, are applied as follows:

- To pay outside liabilities. Debts with fixed charges are paid first, followed by debts with floating charges and then unsecured debts. Such as creditors, loans, bank overdraft, bills payable, etc.

- To pay loans and advances made by the partners to the firm (in case the balance amount is not adequate enough to pay off such loans and advances, they are to be paid proportionately).

- To settle capital accounts of the partners.

Private Debts and Firm’s Debts:

Where both the debts of the firm and private debts of a partner co-exist, the following rules, as stated in Section 49 of the Indian Partnership Act, 1932, shall apply:

(a) The property of the firm shall be applied first in the payment of debts of the firm and then the surplus if any shall be divided among the partners as per their claims, which can be utilized for payment of their private liabilities.

(b) The private property of any partner shall be applied first in payment of his private debts and the surplus, in any, may be utilized for payment of the firm’s debts, in case the firm’s liabilities exceed the firm’s assets. In nutshell, private property shall be first used to settle private debts and business property shall be first used to settle business debts, and the surplus if any, can be transferred.

Accounting Treatment:

Dissolution of the firm involves the realization of assets and settlement of liabilities and capital accounts. For this purpose, the following accounts are opened in the firm’s books:

- Realization Account.

- Partner’s Loan Account

- Partner’s Capital Account

- Bank or Cash Account

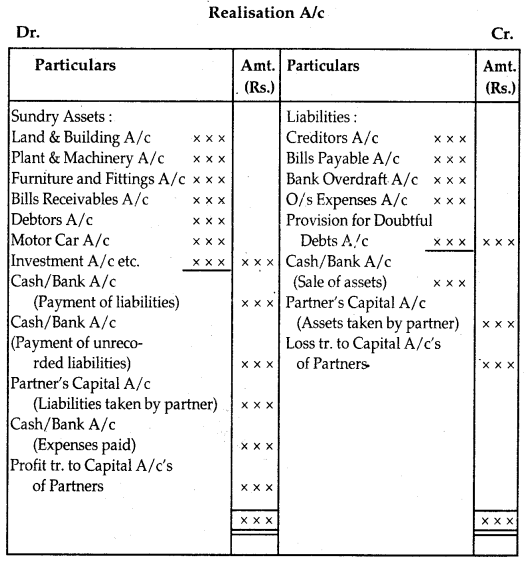

1. Realization Account:

A realization Account is opened on the dissolution of a firm. It is a nominal account. It shows the net result of realization of assets and settlement of liabilities.

For this purpose, the balances of assets and liabilities appearing in the ledger books are transferred to the realization account. It also records realized value of recorded as well as unrecorded assets. Similarly, payment for liabilities and unrecords liabilities are also recorded in the realization account.

It also recorded the realization expenses. The balance in this account is termed as profit or loss on realization which is transferred to partner’s, capital accounts in their profit sharing ratio. As the dissolution of a firm involves winding up of partnership business and requires final closure of books, the following steps are followed to record dissolution of the partnership firm:

→ Journal Entries:

1. For transfer of Assets

Realization A/c Dr.

To Sundry Assets (Individually) A/c [With a book value of individual asset]

All assets transferred to the realization account at their book value and its corresponding provisions or reserve appearing on the balance sheet are also transferred to the credit side of the realization account. Balance of cash, bank, and fictitious assets are not transferred to realization account.

2. For transfer of liabilities

Book value of all outside liabilities recorded in the books is transferred to realization account along with provisions against various assets.

Liabilities A/c (Individually) Dr.

To Realisation A/c [With a book value of Liabilities]

Note:

Partner’s capital account, accumulated profits, general reserves, reserve fund, partner’s loan are not transferred to realization account.

3. For Sale of Assets (recorded or unrecorded)

Bank/Cash A/c Dr.

To Realisation A/c [With the amount actually realized]

4. For an asset taken over by a partner

Partner’s Capital A/c Dr.

To Realisation A/c [ With the agreed take over the price of the assets]

5. For payment of liabilities

Realization A/c Dr.

To Bank/Cash A/c [With the amount actually paid]

6. For a liability which a partner takes responsibility to discharge

Realization A/c Dr.

To Partner’s Capital A/c [With the agreed value of liability taken over]

7. For transfer of assets to settle liabilities

If assets are transferred to settle the liability account (full and final settlement), then no separate journal entry is passed to record settlement of liability by transfer of assets. But if there is a difference, then we have to pass entry.

For example: If the creditor accepts an asset only as part of the payment of his dues, the entry will be made for cash payment. Creditors to whom Rs. 4,000 was due accepts typewriter worth Rs. 3,000 and Rs. 1,000 paid in cash, the following entry shall be made for the payment of Rs. 1,000 only.

If a creditor accepts an asset whose value is more than the amount due to him, he will pay cash to the firm for the difference for which the entry will be:

Bank A/c Dr.

To Realisation A/c

8. For payment of realization expenses;

(a) Expenses paid by the firm:

Realization A/c Dr.

To Bank/Cash A/c

(b) Expenses paid by a partner on behalf of the firm:

Realization A/c Dr.

To Pa liner’s Capital A/c

(c) When a partner has agreed to undertake the dissolution work for an agreed remuneration bear the realization expenses:

1. If payment of realization expenses is made by the firm:

Partner’s Capital A/c Dr.

To Bank/Cash A/c

2. If the partner himself pays the realization expenses:

[No Entry]

3. For agreed remuneration to such partner:

Realization A/c Dr.

To Partner’s Capital A/c

9. For the realization of any unrecorded assets including goodwill

Bank/Cash A/c Dr.

To Realisation A/c

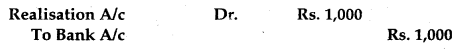

10. For settlement of any unrecorded liability

Realization A/c Dr.

To Bank A/c

11. For transfer of profit and loss on realization

(a) In case of profit

Realization A/c Dr.

To Partner’s Capital A/c (Individually)

(b) In case of loss

Partner’s Capital A/c (Individually) Dr.

To Realisation A/c

Important:

- If nothing is mentioned regarding the sale value of intangible assets like goodwill, prepaid expenses, patents, etc., it is assumed that these are valueless.

- If nothing is mentioned regarding the sale value of tangible assets in the question, it is assumed that these are realized at their book value shown in the Balance Sheet.

→ Accounting Treatment of Reserve and Provisions:

1. If there exists a special reserve against any assets, it should be transferred to the credit side of the Realisation Account.

Provision for Depreciation A/c Dr.

Provision for Bad and Doubtful Debts Dr.

Investment Fluctuation Fund A/c Dr.

Life Policy Fund A/c Dr.

To Realisation A/c

→ These are not to be paid.

(a) Undistributed profits

General Reserve A/c Dr.

Reserve Fund A/c Dr.

Profit and Loss A/c (Credit Balance) Dr.

Workmen Compensation Fund A/c Dr.

To Partner’s Capital A/c (Individually)

(b) Undistributed losses

Partner’s Capital A/c (Individually) Dr.

To Profit and Loss A/c (Debit Balance)

To Advertisement Expenses A/c

2. Partner’s Loan Account:

When all the outside liabilities are paid in full, afterward this loan will be paid.

Partner’s Loan A/c Dr.

To Bank/Cash A/c

3. Partner’s Capital Accounts: After all the adjustments.

(a) If capital account showed debit balance:

Bank/Cash A/c Dr.

To Partner’s Capital A/c (Individually)

(For deficit amount of capital brought in cash by the partner)

(b) If capital account showed credit balance:

Partner’s Capital A/c Dr.

To Bank/Cash A/c (For final payment made to a partner)

4. Bank/Cash Account:

On the debit side of this account, entries as opening balance, sale of assets, and cash brought in by partners are shown and on the credit side, entries as cash payment for liabilities, expenses, and amount paid to partners are shown. If all the entries are correctly recorded, this account balances, and hence all accounts are closed.

Format of Realisation Account

Answer: