Students can also read Online Education MCQ Questions for Class 10 Economics Chapter 3 Money and Credit Questions with Answers hope will definitely help for your board exams. https://ncertmcq.com/mcq-questions-for-class-10-social-science-with-answers/

Class 10 Social Science Economics Chapter 3 MCQ With Answers

Economics Class 10 Chapter 3 MCQs On Money and Credit

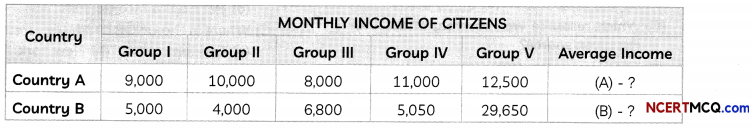

Money And Credit Class 10 MCQ Question 1.

Fill in the blank by choosing the most appropriate option:

The exchange of goods for goods is a process of ………………

(a) Buying goods through currency

(b) Selling goods through currency

(c) Bartering goods

(d) Making goods

Answer:

(c) Bartering goods

Money And Credit MCQ Question 2.

What portion of deposits is essential for the banks to maintain in liquid cash for their day to day transaction?

(a) 10%

(b) 15%

(c) 20%

(d) 25%

Answer:

(b) 15%

Class 10 Economics Chapter 3 MCQ With Answers Question 3.

Which of the following statements is an essential feature of barter system?

(a) Money can easily be used to buy any commodity or service.

(b) The barter system is based on the double coincidence of wants.

(c) The barter system promises payments at a later date than the day of transaction.

(d) The barter system helps the people to buy and sell goods easily and quickly.

Answer:

(b) The barter system is based on the double coincidence of wants.

![]()

MCQ On Money And Credit Class 10 Question 4.

Which one of the following agencies issues currency notes on behalf of the government of India?

(a) The Finance Minister of India issues them.

(b) Reserve Bank of India issues the currency.

(c) All the banks of the country can issue notes.

(d) World Bank issues notes

Answer:

(b) Reserve Bank of India issues the currency.

Money And Credit Class 10 MCQs Question 5.

Which one of the following is not a modern form of money?

(a) Paper currency

(b) Demand Deposits

(c) Coins

(d) Precious metals

Answer:

(d) Precious metals

Explanation: Gold, Silver and Copper were used to make coins in ancient times.

Class 10 Money And Credit MCQ Question 6.

Why do banks keep a small proportion of the deposits as cash with themselves?

(a) To extend loan to the poor

(b) To extend loan facility

(c) To pay salary to their staff

(d) To pay the depositors who might come to withdraw the money.

Answer:

MCQ Money And Credit Question 7.

Which of the following refers to investment?

(a) The money spent on religious ceremonies.

(b) The money spent on social customs.

(c) The money spent to buy assets such as land.

(d) The money spent on household goods.

Answer:

(c) The money spent to buy assets such as land.

![]()

MCQ Of Money And Credit Class 10th Question 8.

Which one of the following is a formal source of credit?

(a) Traders

(b) Cooperative sectors

(c) Money lenders

(d) Friends and relatives

Answer:

(b) Cooperative sector

MCQ Of Money And Credit Class 10 Question 9.

Which among the following issues currency notes on behalf of the central government?

(a) State Bank of India

(b) Reserve Bank of India

(c) Commercial Bank of India

(d) Union Bank of India

Answer:

(b) Reserve Bank of India

Explanation: The Reserve Bank of India is the monitoring agency and the Central Bank of India that issues currency on behalf of the Government of India. No other person can issue any legalised currency. Other banks are all involved in public dealing of money but don’t issue any currency.

MCQs Of Money And Credit Question 10.

Which one of the following options is NOT correct about a typical Self-Help Group?

(a) It has 15-20 members

(b) It does not have any male members.

(c) Its members usually belonging to one neighbourhood

(d) Saving per member varies in it.

Answer:

(b) It does not have any male members.

MCQ Of Chapter Money And Credit Class 10 Question 11.

What percentage of their deposits as cash, do the banks in India keep with themselves?

(a) 20 per cent

(b) 15 per cent

(c) 12 per cent

(d) 10 per cent

Answer:

MCQs On Money And Credit Question 12.

Money is accepted as a medium of exchange because:

(a) It is authorized by the government of India

(b) It is issued by the Reserve Bank of India

(c) It is legalised as a medium of payment in India

(d) All of these

Answer:

(d) All of these

Money And Credit MCQ Class 10 Question 13.

Find the incorrect option:

(a) Demand deposit share the essential features of money

(b) With demand deposit payments can be made without cash

(c) Demand deposits are a safe way of money transformation

(d) Demand deposit facility is like cheque

Answer:

(d) Demand deposit facility is like cheque.

Class 10 Economics Chapter 3 MCQ Question 14.

What do people do with the extra cash in hand? Choose the most correct option from the following:

(a) They deposit it with one of the informal lenders

(b) They deposit it with an NGO

(c) They deposit it with the bank manager

(d) They deposit it with the banks by opening a bank account in their name.

Answer:

(d) They deposit it with the banks by opening a bank account in their name.

![]()

Money And Credit MCQ Questions Question 15.

When do people have the provision to withdraw money? Choose the most appropriate option from the following:

(a) They can withdraw money at the time of severe illness

(b) They cannot withdraw money before it reaches to it maturity level.

(c) They can withdraw money as and when they require

(d) Both (a) and (b)

Answer:

(c) They can withdraw money as and when they require.

Explanation: People deposit money with the bonks by opening a bank account in their name and receive an amount as interest from the bank on this deposit which can be withdrawn by them as and when they require it.

Related Theory

Since the deposits in the bank accounts can be withdrawn on demand, these deposits are called demand deposits.

Question 16.

Money borrowed from banks and cooperative societies comes under which source of credit?

(a) Informal

(b) Formal

(c) Semi-Formal

(d) None of the above

Answer:

(b) Formal

Explanation: Formal sources of credit include Banks and Cooperative Societies which: provide credit at the low rate of interest to the borrowers and are regulated and supervised by the RBI on behalf of the Central Government in India.

Related Theory

The informal lenders include moneylenders, traders, employers, relatives and peer groups. Such lenders are not monitored or regulated by any agency. Most of the times, lenders fix extremely high rates of interest and push borrowers into debt traps through their informal rules.

Unorganized sources of Credit correspond to Informal sources of credit and cannot be trusted.

Question 17.

In a self-help group most of the decisions regarding savings and loan activities are taken by which one of the following:

(a) Bank

(b) Members

(c) NGOs

(d) All of these

Answer:

(b) Members

Question 18.

Formal sources of credit do not include

(a) Banks

(b) Cooperatives

(c) Employers

(d) Both (a) and (b)

Answer:

(c) Employers

Explanation: Employers, moneylenders, neighbors, friends, relatives etc fall under informal sources of credit who charge high interest on loans that they give to the borrowers.

Question 19.

Arrange the following forms of currency according to their usage from oldest to recent use:

(i) Paper Currency

(ii) Grain and cattle

(iii) Coins

(iv) Net banking and digital payments

(a) (iii)-(iv)-(i)-(ii)

(b) (ii)-(iii)-(i)-(iv)

(c) (i)-(ii)-(iiii)-(iv)

(d) (iv)-(iii)-(ii)-(i)

Answer:

(b) (ii)-(iii)-(i)-(iv)

Explanation: In early times, Grain and Cattle were used as barter to buy items of necessity. This was later replaced by silver, gold and copper coins. Post the invention of paper, paper currency dominated the scene. Today net banking and digital payments have replaced paper currency.

Question 20.

Bank deposits are also called

(a) Collateral

(b) Demand deposits

(c) Cheque

(d) Currency

Answer:

(b) Demand deposits

Explanation: Banks provide the facility of depositing surplus cash of citizens safely. They also provide interest on this deposit. Customers can withdraw or deposit cash at any time according to their demand. Hence this is called a demand deposit.

Question 21.

Terms of credit do not include:

(a) Bank deposits

(b) Interest rate

(c) Collateral

(d) Mode of repayment

Answer:

(a) Bank deposits

Explanation: Interest rate, collateral and documentation requirement, and the mode of repayment together comprise what is called the terms of credit. Together, they are all that a lender or borrower needs to consider before borrowing or lending money.

![]()

Question 22.

Rampur is an area where 80% people borrow money from the bank while 10% don’t borrow and the rest 10% take it from their friends, relatives or local moneylenders. Where will Rampur be situated?

(a) In an Urban Region

(b) Semi-Urban area

(c) In a Rural region

(d) Capital of a country

Answer:

(a) In an Urban Region

Explanation: Rampur is located in an area with proper access to banks, however not all the people are convinced borrowers from the bank. In an urban area, most people go to the bank while some people might also resort to friends and relatives for money, due to small or extremely urgent need.

Related Theory

The country’s capital is generally a High-tech city with all educated and skilled people. Hence Rampur can’t be a Capital. It cannot be situated in a rural area because of the large number of banks and easy accessibility. It cannot be a Semi-urban area due to similar reasons.

Question 23.

Find the correct option:

(a) Collateral is what pushes the lender in to a painful debt trap situation.

(b) Collateral is the amount that RBI gets from other banks.

(c) Collateral is an asset that the borrower owns and uses as a guarantee to a lender against the amount borrowed.

(d) Collateral does not include jewellery.

Answer:

(c) Collateral is an asset that the borrower owns and uses as a guarantee to a lender against the amount borrowed.

Explanation: Collateral acts like a guarantee to a lender until loan is repaid, if the borrower fails to repay the loan, the lender can reimburse his loan by selling the collateral or confiscating it.

Related Theory

Property such as land titles, deposits with banks(Jewellery, bonds), livestock are some common examples of collateral used for borrowing. Collateral is a safety valve to lender’s benefit. It does not put the lender in a debt trap because lender lends and not borrows.

Identify

Question 24.

Identify the financial institution on basis of the hints given:

(1) Monitors other Banks

(2) Regulates lending activities

(3) Issues Currencies

Answer:

Reserve Bank of India

Correct and Rewrite/ True-False

State whether the following statements are True or False. If false, correct the statement.

Question 25.

Banks and cooperatives are informal sources of credit.

Answer:

False

Banks and cooperatives are formal sources of credit.

Explanation: Informal sources of credit are locaL moneylenders, sahukars, jewelers, relatives or friends who lend without any proper documentation and charge exorbitant rates of interest. Banks and Cooperatives are backed by the government and hence are formal sources of credit.

Double coincidence of wants is an essential feature of Barter system.

![]()

Fill in the blanks with suitable information:

Question 27.

………….. is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Answer:

Collateral

Explanation: Property such as land, building, vehicle, livestock, jewellery, bonds deposits with banks are some common examples of collateral used for borrowing.

Match the Columns

Choose the correct pairs option from the following:

Match the correct people involved in a variety of occupations with the appropriate reason they might borrow money for:

| Column A | Column B |

| (a) Auto-rickshaw driver | (i) To buy a house |

| (b) A businessman whose factory has closed down | (ii) To buy a shop of his own |

| (c) Small trader | (iii) To revive his business |

| (d) A person in government service | (iv) To buy his own vehicle |

Answer:

| Column A | Column B |

| (a) Auto-rickshaw driver | (iv) To buy his own vehicle |

| (b) A businessman whose factory has closed down | (iii) To revive his business |

| (c) Small trader | (ii) To buy a shop of his own |

| (d) A person in government service | (i) To buy a house |

Assertion Reasoning questions Class 10 Economics Chapter 3

In each of the following questions, a statement of Assertion (A) is given followed by a corresponding statement of Reason (R). Select the correct answer to codes (a), (b) (c), or (d) as given below:

(a) Both (A) and (R) are true and (R) is the correct explanation of (A).

(b) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(c) (A) is correct but (R) is wrong.

(d) (A) is wrong but (R) is correct.

Question 29.

Assertion (A): Not all the money that is deposited in the bank by the depositors is kept by the banks themselves.

Reason (R): They use it to further extend loans to people so that the difference between interest earned and interest is given can be further invested and the chain will continue to go on.

Answer:

(b) Both (A) and (R) are true but (R) is not the correct explanation of (A).

Explanation: Banks make use of the deposits to meet the loan requirements of people. In this way, banks mediate between those who have surplus funds (the depositors) and those who are in need of these funds (the borrowers). They don’t invest the interest earned again, they use it to provide income to their employees.

Question 30.

Assertion (A): If the borrower fails to repay the loan, the lender does not have the right to sell the asset or collateral to obtain payment.

Reason (R): Collateral acts like a guarantee against the borrowed money.

Answer:

(d) (A) is wrong but (R) is correct.

Explanation: If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

![]()

Question 31.

Assertion (A): The terms of credit vary substantially from one credit arrangement to another.

Reason (R): Interest rates, time periods vary from one arrangement to other.

Answer:

(a) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 32.

Assertion (A): Members of a cooperative pool their resources for cooperation in certain areas.

Reason (R): They pool their funds together.

Answer:

(b) Both (A) and (R) are true but (R) is not the correct explanation of (A).

Explanation: Cooperatives are formed with the purposes of sharing resources and collecting resources.

Question 33.

Assertion (A): Banks have to submit information to the RBI on how much they are lending, to whom, at what interest rate, etc.

Reason (R): This is done to ensure the rich get enough loans.

Answer:

(c) (A) is correct but (R) is wrong.

Explanation: Banks have to submit periodical reports and this is done to ensure appropriate amounts of loans are given to the poor and vulnerable classes.

(Competency Based Questions (CBQs))

Question 1.

Match the items in Column A to those in Column B

|

Column A (Organisation) |

Column B(Its Field of Interest) |

| (A) NSSO | (I) Data on Self Help Groups |

| (B) NABARD | (II) Economic planning |

| (C) RBI | (III) Formal and Informal Sector Credit data and survey |

| (D) NITI AAYOG | (IV) Monitors the banks and credit activities |

(a) (A)-(I), (B)-(III), (C)-(IV), (D)-(II)

(b) (A)-(III), (B)-(I), (C)-(IV), (D)-(II)

(c) (A)-(II), (B)-(III), (C)-(IV), (D)-(I)

(d) (A)-(IV), (B)-(III), (C)-(II), (D)-(I)

Answer:

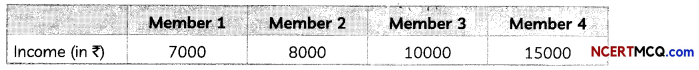

Question 2.

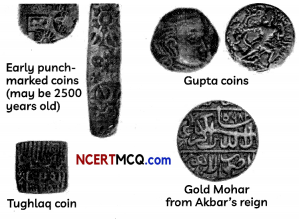

Study the picture given below and answer the question that follows:

Currency in the era of kings were made from:

(a) Gold, Silver and Copper

(b) Ivory and Bones

(c) Grains and Water

(d) Rice and Water

Answer:

(a) Gold, Silver and Copper

![]()

Question 3.

Rita has taken a loan of ? 7 lakhs from the bank to purchase a car. The annual interest rate on the loan is 14.5 per cent and the loan is to be repaid in 3 years in monthly instalments.

The bank retained the papers of the new car as collateral, which will be returned to Rita only when she repays the entire loan with interest.

Analyse the loan information given above, and point out which one of the following is the correct option that describes the above statements accurately.

(a) Mode of re-payment

(b) Terms of credit

(c) Interest on loan

(d) Deposit criteria

Answer:

Question 4.

Read the given source and answer the question that follows:

No individual in India can legally refuse a payment made in rupees. Hence, the rupee is widely accepted as a medium of exchange.

Who legalises the use of rupee as a medium of payment that cannot be refused in settling transactions in India?

(a) SBI

(b) Indian Law

(c) RBI

(d) The constitution of France

Answer:

(b) Indian Law

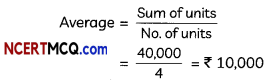

Question 5.

Observe the picture carefully.

Describe this image in your own words.

Answer:

This image showcases a meeting of a women self-help group.

Explanation: A typical Self Help Group has 15-20 members, usually belonging to one neighbourhood, who meet and save money regularly. Members can take small loans from the group itself to meet their needs on smaller rates of interest.

Question 6.

Read the source given below and answer the questions that follow:

Besides banks, the other major source of cheap credit in rural areas are the cooperative societies (or cooperatives). Members of a cooperative pool their resources for cooperation in certain areas. There are several types of cooperatives possible such as farmers cooperatives, weavers cooperatives, industrial workers cooperatives, etc. Krishak Cooperative functions in a village not very far away from Sonpur. It has 2300 farmers as members. It accepts deposits from its members. With these deposits as collateral, the Cooperative has obtained a large loan from the bank. These funds are used to provide loans to members. Once these loans are repaid, another round of lending can take place. Krishak Cooperative provides loans for the purchase of agricultural implements, loans for cultivation and agricultural trade, fishery loans, loans for construction of houses and for a variety of other expenses.

(A) The Cooperatives can be classified into sector.

(a) Formal

(b) Informal

(c) Mixed

(d) Unorganised sector

Answer:

(a) Formal

Explanation: Cooperatives are registered and monitored by regulating authorities.

(B) The cooperatives lend without which of the following terms of credit:

(a) Collateral

(b) Interest Rate

(c) Identification

(d) Specific time period for repayment

Answer:

(a) Collateral

(C) Name one type of cooperative mentioned in the source.

Answer:

(D) Assertion (A): Informal sector loans prove to be worse than formal sector loans.

Reason(R): Formal sector loans need less paperwork.

(a) Both (A) and (R) are true and (R) is the correct explanation of (A).

(b) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(c) (A) is correct but (R) is wrong.

(d) (A) is wrong but (R) is correct.

Answer:

(c) (A) is correct but (R) is wrong.

Explanation: Informal sector loans prove to be worse than formal sector loans because the former have no paperwork or documentation. It leads lenders into debt traps.

![]()

Question 7.

Read the source given below and answer the questions that follow:

Swapna, a small farmer, grows groundnut on her three acres of land. She takes a loan from the moneylender to meet the expenses of cultivation, hoping that her harvest would help repay the loan. Midway through the season the crop is hit by pests and the crop fails. Though Swapna sprays her crops with expensive pesticides, it makes little difference. She is unable to repay the moneylender and the debt grows over the year into a large amount. Next year, Swapna takes a fresh loan for cultivation. It is a normal crop this year. But the earnings are not enough to cover the old loan. She is caught in debt. She has to sell a part of the land to pay off the debt Answer the following MCQs by choosing the most appropriate option:

(A) Swapna obtains credit from which of the following sectors?

(a) Formal Sector

(b) Informal Sector

(c) Public sector

(d) Private sector

Answer:

(b) Informal Sector

(B) Which of the following conditions holds true for Swapna?

(a) Her crop was destroyed and this raised her income.

(b) She borrowed from the moneylender and it did not do anything to add to her incomes and thus it was a bad credit.

(c) She was easily able to pay back what she borrowed.

(d) The credit was good but Swapna was not a good farmer.

Answer:

(C) How could Swapna improve her situation?

(a) She could borrow more.

(b) She could borrow less.

(c) She could stop farming.

(d) She could borrow form bank

Answer:

(d) She could borrow from banks.

Explanation: Formal Sector lends at a lowest rate and thus helps the lender to actually increase his income and lifestyle.

(D) What does Swapna’s situation portray about the rural households and credit?

(a) Rural Households cannot handle credit.

(b) Rural Households need more credit.

(c) Rural Households borrow mostly from Informal sources.

(d) Rural Households borrow throughout the year.

Answer:

(c) Rural Households borrow mostly from informal sources.

Question 8.

Read the source given below and answer the questions that follow:

In recent years, people have tried out some newer ways of providing loans to the poor. The idea is to organise rural poor, in particular women, into small Self Help Groups (SHGs) and pool (collect) their savings. A typical SHG has 15-20 members, usually belonging to one neighborhood, who meet and save regularly. Saving per member varies from Rs. 25 to Rs. 100 or more, depending on the ability of the people to save. Members can take small loans from the group itself to meet their needs. The group charges interest on these loans but this is still less than what the moneylender charges. After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank. The loan is sanctioned in the name of the group and is meant to create self-employment opportunities for the members.

Answer the following MCQs by choosing the most appropriate option:

(A) Apart from saving and lending, what else is the Self Help Group useful for?

(a) It is a place for taking political decisions

(b) It is a place for discussing social issues

(c) It is a place for entertainment

(d) Both (a) and (b) are correct.

Answer:

(d) Both (a) and (b) are correct.

Explanation: The regular meetings of the group provide a platform to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

(B) What is their saving per member in the group?

(a) Between 20-100 rupees

(b) Below 20 rupees

(c) Above 100 rupees

(d) Varies with states

Answer:

(a) Between 20-100 rupees

(C) What does a Self Help Group have to do to become eligible to borrow from the bank?

(a) Save more

(b) Spend more

(c) Save regularly

(d) Save, lend and repay regularly

Answer:

(d) Save, lend and repay regularly

Explanation: After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

(D) Who takes the decisions regarding the savings and loan activities in a Self Help Group?

(a) Head of the Self Help Group

(b) Mayor

(c) Zila Parishad

(d) All the members of the Self Help Group

Answer:

(d) All the members of the Self Help Group.

![]()

Question 9.

Read the source given below and answer the questions that follow:

In rural areas, the main demand for credit is for crop production. Crop production involves considerable costs on seeds, fertilisers, pesticides, water, electricity, repair of equipment, etc. There is a minimum stretch of three to four months between the time when the farmers buy these inputs and when they sell the crop. Farmers usually take crop loans at the beginning of the season and repay the Loan after harvest. Repayment of the loan is crucially dependent on the income from farming. Credit, instead of helping Swapna improve her earnings, left her worse off. This is an example of what is commonly called debt-trap. Credit in this case pushes the borrower into a situation from which recovery is very painful

Answer the following MCQs by choosing the most appropriate option:

(A) Which of the following will be an appropriate reason farmers can lend money?

(I) to arrange for funds for sister’s marriage.

(II) to buy a new factory

(III) to build a new swimming pool

(IV) to buy new fertiliser

(a) (I) only

(b) (II) & (III) only

(c) (I) & (IV) only

(d) (I), (II) & (IV) only

Answer:

(c) (I) & (IV) only

(B) Fill in the blank by choosing the most appropriate option:

Farmers generally borrow loans from sector.

(a) Unorganised

(b) Organised

(c) Formal

(d) Informal

Answer:

(a) Unorganised

(C) Which of the following situations will lead to a debt trap?

(a) When loans do not add anything to the income of the borrower, it becomes difficult for him to repay, then he has to borrow more to repay, this leads to a debt trap.

(b) When loans help to increase the income, a debt trap is formed.

(c) When loans are paid on time, a debt trap is formed.

(d) When loans are borrowed again and again, a debt trap is formed.

Answer:

(a) When loans do not add anything to the income of the borrower, it becomes difficult for him to repay, then he has to borrow more to repay, this leads to a debt trap.

(D) Which role does credit play according to the situation given in the source?

(a) Positive

(b) Negative

(c) Both (a) & (b)

(d) Neutral

Answer:

(b) Negative

Very Short Answer Type Questions

Question 1.

How do deposits with banks become their source of income?

Answer:

They charge different rates of interest on the money they loan and the deposits of the customers. The difference forms their revenue and source of income.

Question 2.

Why do farmers require credit?

Answer:

Farmers require credit to buy seeds, fertilisers or other equipment related to farming apart from personal or family needs.

![]()

Question 3.

M. Salim wants to withdraw Rs. 20,000 in cash for making payments to Prem after Prem receives the money he deposits it in his own account? What is the result?

(a) Salim’s balance in his bank account increases and Prem’s balance increases.

(b) Salim’s balance in his bank account decreases and Prem’s balance increases.

(c) Salim’s balance in his bank account increases, and Prem’s balance decreases.

(d) None of the above.

Answer:

(b) Salim’s balance in his bank account decreases and Prem’s balance increases.

Question 4.

Why is the higher cost of borrowing bad for investors?

Answer:

Question 5.

Why is it difficult for poor people to get loans from the Banks?

Answer:

It is difficult because often they do not have the required collateral or documents necessary for borrowing money.

Question 6.

Krishna is working in a neighboring field on very less wage. Expenses on sudden illnesses or functions in the family are also met through loans. The landowner charges an interest rate of 5% per month. At present, she owes the landowner ₹ 5,000.

Analyse his credit arrangements given above.

Answer:

Question 7.

How is money beneficial in transactions?

Answer:

Money has made transactions easy as it solves the problem of double coincidence of wants by acting as a medium of exchange.

Related Theory

Double coincidence of wants occurs when two individuals swap their goods, in exchange for one another’s. This is also referred to as the ‘perfect barter exchange’.

Question 8.

Give one example each of modern currency and older currency.

Answer:

Examples of modem currency are paper bills/notes, coins, credit cards etc., whereas examples of older currency are coins made of precious metals like gold or silver and also terracotta coins, etc.

Related Theory

Money can be defined as anything that acts as medium of exchange, store of value and unit of accounting to facilitate the economic activities and transactions.

Question 9.

Explain the inherent problem of the ‘barter system’.

Answer:

Question 10.

Why are demand deposits considered as money?

Answer:

Demand deposits are considered as money because they can be withdrawn from the bank as and when needed. Also, they are accepted widely as a means of payment by way of a cheque instead of cash.

Related Theory

People with surplus money or extra amount deposit it in banks. Banks keep the money safe and give an interest on it. The deposits can be drawn at any time on demand by the depositors. That is why they are called demand deposits.

![]()

Question 11.

Which bank issues ‘currency notes’ in Indie on behalf of the central government?

Answer:

The Reserve Bank of India issues currency notes in India on behalf of federal government.

Related Theory

Reserve Bank of India (RBI) manages and monitors the working of other banks and also plays the role of a bank to other banks as well as the government

Question 12.

How do the deposits with banks become their source of income?

Answer:

Banks use a major portion of its deposits to extend loans to people, for which they charge high interests and this is how the deposits with banks become their source of income.

Related Theory

The banks mediate between the depositors and the borrowers. Banks charge a higher interest rate on loans than what they pay on the deposits. The difference between the interest charged from the borrowers and what is paid to the depositors is, thus, the main source of income for the banks.

Question 13.

Why is money called a medium of exchange?

Answer:

Money is accepted as a ‘medium of exchange’ because it acts as an intermediary in the process of exchange. A person holding money can easily exchange it for any commodity or service.

Related Theory

Money helps to facilitate trade because people in the economy generally recognise it as valuable. Earlier, barter system was used as a medium of exchange and later, gold was adopted as an intermediary.

![]()

Question 14.

What can be the alternative mode of payment in place of cash money?

Answer:

Cheques and demand deposits’ are two alternative modes of payment that can be used in place of cash money.

Related Theory

Digital payment through the internet and mobile wallets is also a good alternative for cash. Plastic money like credit and debit cards are also used instead of cash in the market.

Question 15.

Explain the meaning of currency.

Answer:

Currency in the form of money: paper notes and coins.

Question 16.

How is a double coincidence of wants not appreciable in the contemporary scenario?

Answer:

Double coincidence of wants not appreciable: What a person desires to sell is exactly not what the other wishes to buy.

Question 17.

Why do banks ask for collateral while giving loans?

Answer:

Banks use collateral as a guarantee until the loan is repaid.

Question 18.

How do the Demand Deposits offer facilities

Answer:

Demand Deposits offer facilities as:

It offers essential characteristics of money/ Safe transfer of money.

Question 19.

What is credit?

Answer:

![]()

Question 20.

What are formal sources of credit?

Answer:

Banks and Cooperative societies which charge less interest on loan are called formal sources of credit.

Question 21.

Give one reason that prevents a rural poor from getting a formal loan.

Answer:

Lack of collateral

Question 22.

What is a cheque?

Answer:

A cheques is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued.

Question 23.

What do terms of credit include?

Answer:

The terms of credit include interest rate, collateral, documentation requirement, mode of payment.

MCQ Questions for Class 10 Social Science with Answers

Class 10 Social Science Economics MCQ: