CA Foundation Business Laws Study Material Chapter 3 Consideration

WHAT IS CONSIDERATION?

- Consideration is an essential element in a contract. It is the normal ‘badge of enforceability’. Subject to certain exceptions, an agreement is not enforceable unless each party to agreement gets something. This “something” is called consideration. It is also called as “quidpro quo”

- A promise without consideration is called nudum pactum. The law will not enforce a bare promise (nudumpactum) but only a bargain ie. promise supported by consideration.

- According to Pollock “Consideration is the price for which the promise of the other is bought”. Consideration is also defined as the ‘element of exchange in a contract’.

- In the English case, Curie v. Misa (1875) L.R Ex. 153 consideration was defined as “some right, interest, profit or benefit accruing to one party, or some forbearance, detriment loss or responsibility given, suffered or undertaken by the other”. In simple words, consideration is ‘a benefit to one party or a detriment to the other’.

- Section 2(d) of the Contract Act define consideration as follows:

(a) “When, at the desire of the promisor,

(b) the promisee or any other person

(c) has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing, something,

(d) such act or abstinence or promise is called a consideration for the promise. ”

ESSENTIALS OF VALID CONSIDERATION

1. Consideration must move at the desire of the promisor

The act or abstinence must be done at the desire of the promisor. If it is done at the instance of a third party or without the desire of the promisor, it is no consideration. In Durgaprasad v. Baldev 1880 3 ALL 221, the plaintiff, baldev, at the desire and request of the collector of the town expanded money in the construction of a market in the town. Subsequently the de-fendants, Durgaprasad & ors. Occupied the shops in the market. Since the plaintiff had spent money for the construction of the market, the defendants in consideration thereof, promised to pay to plaintiff, a commission on the articles sold through their (defendants) shops in that market. Defendants however, failed to pay the promised commission, the plaintiff brought an action to recover the promised commission. It was held that they were not bound to pay as it was without consideration and hence void)

However, consideration need not be to the benefit of the promisor. In Kedarnath v. Gorie Mohamed (1886) ILR 14 Cal 64, on the strength of the promise of the defendant to give donation the plaintiff started the construction of town hall. It was held that the defendant was liable to pay as the construction work started by the plaintiff was done at the desire of the defendant (the promisor) so to constitute consideration. However, if the plaintiff that is promisee did not incurred any liability on the promise of the donation then the defendant is not liable (Abdul Aziz v. Masum Ali, 1914).

2. Consideration may move from the promisee or any other person

Consideration may be supplied by the promisee or any other person. But the stranger to the consideration will be able to sue only if he is a party to the contract. The leading case is of Madras High Court in Chinnaya v. Ramaya (1882) 4 Mad 137.

An old lady (A) had a highly valued estate. She made a contract with her daughter (R) that the whole of the property shall be gifted to R if R agrees to pay annuity to C (C was the sister of A). R made a contract with C agreeing to pay C annuities. After the death of A, R stopped the payment of annuities on the ground that no consideration had passed from C to R and therefore agreement between C and R was void. The Court held that the consideration had been furnished to R (since the property was gifted to R at the desire of R). It was immaterial that A had furnished this consideration. As long as there is consideration in a contract, it is immaterial as to who has given this consideration.

3. Consideration may be an act or abstinence

A person may promise to do something or not to do something for a promise. To do or not to do something in return is consideration. If A promises to give Rs. 10,000 to B, if B stops smoking, it will be a good consideration.

4. Consideration may be past, present or future

When the consideration of one party was given before the date of the promise, it is said to be past. Past consideration means the consideration for a promise given by a party before the promise is made. It is the consideration given earlier by a party and the promise is made thereafter. Such a consideration given by a party must be at the desire of the promisor. Past voluntary services rendered by a party cannot be said to be the past consideration.

Example: A requests B to search out his lost cow. B searched out and deliver the cow to A. thereafter A promises to pay B Rs. 500 as a reward. Here, the efforts to B at the request of A constitutes a valid past consideration for the promise by A to pay 1500 to B. The consideration by B was given before the promise to pay is made by A.

Consideration which moves simultaneously with the promise is called present or executed consideration. Cash sales are good examples of present or executed consideration. The seller delivers the articles sold and the buyer simultaneously pays the price of them.

When the consideration is to move at a future date, it is called future or executory consideration.

Example: X promise to deliver to Y certain electric appliances as soon as he receives them from the wholeseller at Bombay and Y promises to pay Rs. 5,000 against the delivery of the articles. Here is future consideration which is to be performed by both the parties when supplies are received from Bombay.

5. Consideration need not he adequate

Consideration need not be adequate nor equivalent to promise.

Illustration: A agrees to sell his horse worth Rs. 1,000 for Rs. 10 only. The consideration is valid though inadequate, as there is something of value to be given by the buyer (Attached to Sec. 25).

However, Sec. 25 (Explanation 2) provides that inadequacy of the consideration may be taken into account by the Court in determining the question whether the consent of the promisor was freely given.

6. Consideration must be real and not illusory

Consideration must be real or of some value in the eyes of law. It should not be physically impossible or illegal or illusory for e.g. to make a dead man alive.

Instances of good consideration:

- Forbearance to sue;

- Compromise of disputed claims

- Composition with creditors

- To avoid disputes in future

7.Consideration must be lawful

Consideration given for an agreement must be lawful one. Consideration must not be illegal, immoral or opposed to public policy.

8. Consideration must not be a pre-existing obligation or duty.

Consideration must not be something, which a person is already bound by law to do. Discharging of pre-existing obligation is no consideration. A person may be bound to do something by law, e.g. to give evidence when called by the Courts. Performance of a legal obligation is no consideration for a promise and therefore the witness cannot demand money to give evidence.

‘NO CONSIDERATION NO CONTRACT’ – EXCEPTIONS TO THE RULE

The general rule is “an agreement made without consideration is void” (Opening words of Sec. 25).

Thus where A promises, for no consideration, to give to B Rs. 1000 this is a void agreement.

However, sec. 25 also mentions some exceptions to the general rule. These exceptions are given below:

A. Agreement made on account of natural love and affection [sec. 25(1)]

An agreement made without consideration is enforceable if it is

- made on account of natural love and affection,

- between parties standing in a near relation to each other,

expressed in writing, and - registered under the law.

In Rajlakhi Debi v. Bhootnath Mukerjee case (1900) 4 Cal WN 488, a husband promised to pay to his wife, after constant quarrels between them, a fixed monthly amount for her maintenance and separate residence without any consideration. The promise was in writing and registered. When he refused to pay, the wife filed a case. She was not allowed anything by court on the ground that the j exception was not applicable as there was no natural love left between them.

B. Agreement to compensate for past voluntary service [sec. 25(2) ]

A promise made without consideration is also valid, if it is a promise to compensate, wholly or in part, a person who has already voluntarily done something for the promisor, or done something which the promisor was legally compellable to do. The following two situations are covered by this section:

(A) Voluntary Services:

When there is a voluntary act by one party and there is a subsequent promise to pay compensation to the former. E.g. A finds B’s purse. B promises to give him Rs. 500 this promise is enforceable.

(B) Legally Compellable Duty:

Another situation covered by the exception is where the promisee has done something for the promisor, “which the promisor was legally compellable to do”.

A subsequent promise to pay for such an act is enforceable. E.g. T supports the son of E F promises to pay the expenses to T. Here T has done something, which the promisor was legally bound to do. This is a valid contract.

C. Agreement to pay a time-barred debt [sec. 25(3)]

Where there is an agreement,

- made in writing and

- signed by the debtor, or by his authorised agent,

- to pay wholly or in part a debt barred by the law of limitation, the agreement is valid even though it is not supported by any consideration.

A time barred debt is one which remains unpaid or unclaimed for a period of 3 years, hence it can-not be recovered under the Indian Limitation Act and therefore a promise to repay such a debt is without consideration, hence the importance of the present exception.

D. Completed Gift

Gift is transfer of property without consideration. In order to be valid a gift does not require consideration. As per Explanation 1 to section 25, gifts given by donor to donee are valid. Once a gift has been actually given, the donor cannot demand it back on the ground that there was no consideration.

Promise for a donation is not a gift. As such a promise for a donation is invalid for want of consid-eration.

E. Contract of Agency

Sec. 185 of the Contract Act lays down that no consideration is necessary to create an agency.

F. Bailment

Sec. 148 of the Contract Act lays down that no consideration is necessary in case of a gratuitous bailment.

G. Remission.

Sec. 63 of the Contract Act lays down that where a person agrees to receive less than what is due to him, such an agreement is said to be an agreement of remission. No consideration is required for a contract of remission.

H. Guarantee

Sec. 127 of the Contract Act lays down that under the contract of guarantee, no consideration is received by the surety, even then the contract of guarantee is valid.

I. Charity

If the promise undertakes the liability on the promise of the person to contribute to charity, there the contract shall be valid as held in Kedarnath v. Gorie Mohammad.

CAN A PERSON WHO IS NOT A PARTY TO A CONTRACT SUE UPON IT?

The doctrine of Privity of Contract: According to the doctrine of privity of contract only a party to a contract is entitled to enforce a right created by the contract. No one is entitled to or bound by the terms of a contract to which he is not an original party. A third party (stranger to contract) has no locus standi in a contract, he is debarred from interfering with the contractual rights or obligations of the parties. Only a person who is a party to a contract can sue on it. The doctrine of privity of contract prevent imposition of contractual obligations upon a person without his consent.

D bought tyres from Dunlop Rubber Co. and sold them to S, a sub-dealer, who agreed with D not to sell below Dunlop’s list price and to pay to Dunlop co. $ 5 as damages on every tyre he undersells. S sold two tyres at less that the list price, and thereupon, the Dunlop co. sued him for the breach. Will the Dunlop Co. succeed?

No. Dunlop Co. cannot claim the benefit of the contract as against S, a sub-dealer. There is no privicy of contract between the two.

Difference between the right of a stranger to a contract and of a stranger to the consideration.

A stranger to a contract, Le., one who is not a party to it, cannot file a suit to enforce it. A contract between P and Q cannot be enforced by R. But a stranger to the consideration can sue to enforce it provided that he is a party to the contract. A contract between P, Q and R whereby P pays money to Q for delivering goods to R can be enforced by R although he did not pay any part of the con-sideration.

Upon A’s marriage his father and father-in-law entered into a contract to contribute a certain sum of money to be given to A after his marriage. A’s father paid his contribution but his father-in-law failed to pay. Held: A could not sue his father-in-law since he (A) was a stranger to the contract [Tweddle v. Atkinson (1861) 1 B. & S. 393],

Exceptions – There are certain exceptions to the rule that a stranger to the contract cannot sue upon it.

They are as follows:

1. Beneficiaries in the case of trust

An agreement to create a trust can be enforced by the beneficiary (though he was not a party to the contract between the settlor and the trustee). S agrees to transfer certain properties to T to be held by T in trust for the benefit of B. B can enforce the agreement though he was not a party to the agreement.

In Khwaja Muhammad v. Hussaini Begum (1910) 32 ALL 410, A and B made an agreement that A’s son S, and B’s daughter D, would be married, both being minors at the time. In con-sideration of this marriage, A promised to B that he will give to D, his daughter-in-law, an amount in perpetuity as, what is a traditional payment, ‘kharcha-e-paan daan’. He even made his immovable property liable for the payment. After the marriage, S and D separated on ac-count of some quarrel. D filed a case against A for the recovery of the promised amount.

In spite of A’s argument that D was a stranger to his contract with B, court allowed D to recover the amount because A had specifically charged his immovable property for the liability. This charge did not amount to creation of a trust, but the seriousness of the situation was found to be similar to that of the trust.

2. Family settlement

When family disputes are settled by mutual agreement and the terms of settlement are writ¬ten down in a document it is called a Family Settlement. Such agreements can be enforced by members of the family who were not originally parties to the settlement.

3. Assignee of contract

In case of assignment of a contract, when the benefit under a contract has been assigned, the assignee can enforce the contract for e.g., S sell goods to B and is entitled to receive the price. S may by giving notice to B assign his right to receive the price in favour of third party X. X, the assignee, may then sue B for the price of goods. The assignee of an insurance policy can sue even though he was not party to it.

4. Provision for marriage or maintenance.

At the time of partition of property of a joint family, the male members may agree that a certain portion of property shall be kept aside for the benefit of, for example, some elderly person or the education and marriage of a female child. Such beneficiaries may not be party to the arrangement. But, they have been held entitled to enforce the agreement for their benefit (Sundararaja v. Lakshmi Ammal( 1914) 38 Mad 788).

5. Contracts entered into through an agent

The principal can enforce the contracts entered into by his agent provided the agent acts within the scope of his authority and in the name of the principal.

6. Acknowledgement

The person who becomes an agent of third party by acknowledgement or otherwise, can be sued by such third party. (If the promisor acknowledges his liability to the third person, then such a third person can file a suit to recover the benefit.)

Example: X gives to Y Rs. 5,000 again to be given to Z. Y informs Z that the holding the money for him. Later on, Y refuses to pay the money. Z is entitled to recover the money from Y (Lily v. Hays, 1886, HIER 1272).

7. Covenants attached with the land

In case of covenant running with the land, the person who purchases land with the notice that the owner of the land is bound by certain duties affecting the land, the covenant affecting the land may be enforced by the successor of the seller.

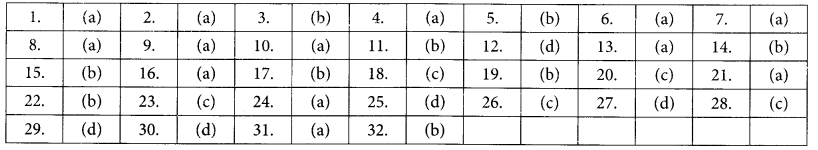

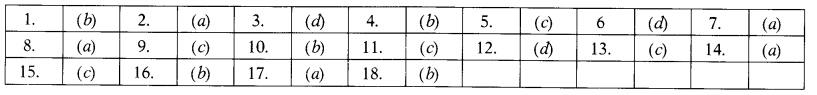

MULTIPLE CHOICE QUESTIONS:

1. If there is no consideration, then

(a) The agreement is void

(b) The agreement is valid

(c) The agreement is illegal

(d) The agreement is voidable

2. A valid consideration has the following essential elements :

(a) It must move at the desire of the promisor

(b) Consideration may be supplied by the promisee or any other person

( c) Consideration may be past, present or future

(d) All the above

3. The latin term “quidpro quo” refers to :

(a) Something in return

(b) Stranger to consideration

(c) Something sensible

(d) Something valuable

4. A promise to pay a time-barred debt must be :

(a) Oral

(b) Written and signed

(c) Registered

(d) Written and registered

5. A stranger to a consideration

(a) Can file a suit

(b) Cannot file a suit

(c) Can file, only with consent of court

(d) Is similar to stranger to a contract

6. A stranger to a contract

(a) Can file a suit

( b) Can file a suit only with permission of court

(c) Can file a suit, if contract is in writing

(d) Cannot file a suit

7. An agreement not supported by consideration is called :

(a) Consensus ad idem

(b) Ignoratia juris non execuset

(c) Ab initio

(d) Nudum Pactum

8. Past consideration means

(a) Money received in the past without making even a proposal

( b) The price which is more than the promisee’s expectation

(c) A past act done before the promise is made

(d) None of the above

9. In India, a person who is stranger to the consideration

(a) Can sue on the contract, if he is a party

(b) Cannot sue the contract

(c) Depends on the parties

(d) Depends on the circumstances

10. A promise to pay a time barred debt is enforceable, if some conditions are fulfilled. Which of the following conditions is not required?

(a) It must be signed by the promisor

(b) It must be definite and express

(c) It must be in writing

(d) It must be registered

11. X promised Y, a priest, to pay Rs. 10,000 as charity. The priest on X’s promise incurred certain liabilities towards the repairing of the temple to the extent of Rs. 7,500. Y, the priest, can recover from X

(a) Rs. 10,000

(b) Rs. 7,500

(c) Nothing

(d) Rs. 7,500 plus damages

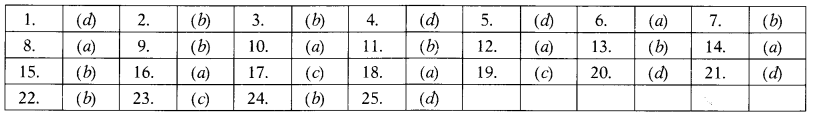

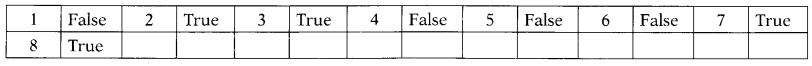

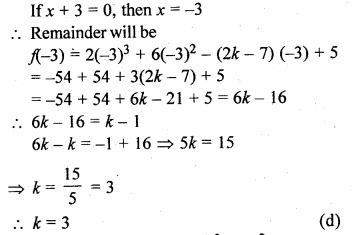

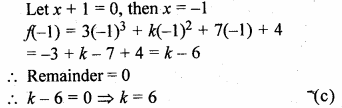

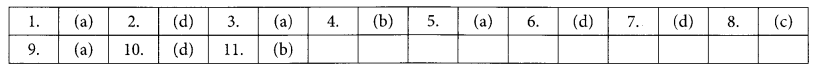

Answers:

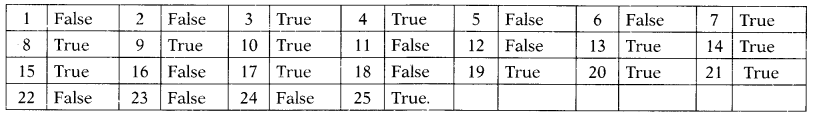

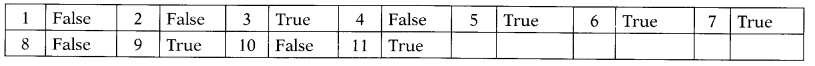

STATE WHETHER THE FOLLOWING ARE TRUE OR FALSE:

1. Inadequacy of consideration does not affect the validity of a contract.

2. A stranger to the contract can enforce the contract.

3. Consideration need not be material and may even be abstract.

4. Consideration must move simultaneously with promise.

5. A stranger to the consideration can enforce the contract.

6. Forbearance to sue or compromising disputed claim is no good consideration.

7. Consideration is essential for the validity of a contract in all cases.

8. Adequacy of consideration is essential for validity of a contract.

9. No consideration is required to create agency.

10. Past consideration is no consideration

11. According to the doctrine of “Privicy of contract”, a stranger to a contract, if he is beneficiary cannot enforce the contract.

12. Inadequacy of consideration cannot be taken into account by the court in determining whether the consent was given freely.

13. The manufacture of goods can enforce conditions imposed upon the dealer against the sub-dealer.

14. In the Indian Law, consideration must move from the promise only.

15. In discharge of the whole claim, a party to the contract agrees to accept a lesser amount than due, from the other party is a valid contract inspite of inadequate consideration.

16. Consideration may move even from a person who is not a party to the contract.

17. A promise to pay a time barred debt is not enforceable.

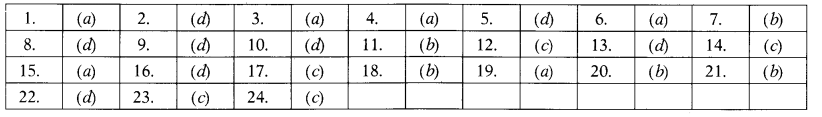

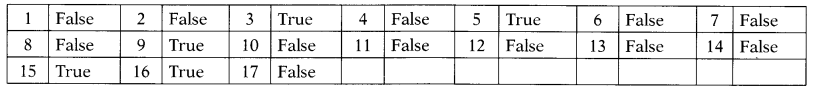

Answers:

>

>