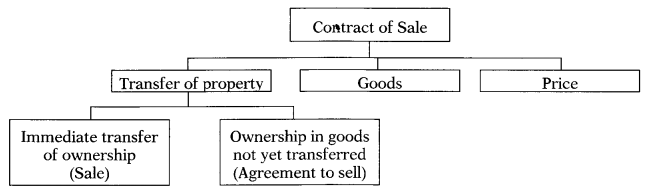

CA Foundation Business Laws Study Material Chapter 12 Transfer of Ownership

TRANSFER OF OWNERSHIP:TIME OF TRANSFER

Sale of goods involves transfer of ownership of property from the seller to the buyer. It is necessary to determine the precise moment of time at which the ownership of the goods passes from the seller to the buyer, because of the following reasons:

(a) Risk passes with property

The general rule is that risk prima facie passes with the property. If the goods are lost or damaged by accident or otherwise, then, subject to certain exceptions, the loss falls on the person who is the owner at the time when the goods are lost or damaged.

(b) Action against third parties.

If the goods are damaged by the action of third parties it is the owner who can take action.

(c) What is the effect of insolvency?

In case of insolvency of either the buyer or the seller it is necessary to know’ whether the goods will be taken over by the Official Assignee. The answer depends upon whether the ownership of the goods is with the party who has become insolvent.

(d) Suit for price.

Unless the contract provides otherwise, a suit for price by the seller does not lie unless the

property has passed to the buyer.

LAW RELATING TO PASSING OF RISK IN CASE OF THE SALE OF GOODS

The basic principle is the risk prima facie passes with the ownership. According to section 26—

Unless otherwise agreed, the goods remains at the seller’s risk until the property therein is transferred to the buyer. But when the property therein is transferred to the buyer, the goods are at the buyer’s \ risk whether delivery has been made or not.

Thus risk and ‘property’ (ownership) go together. But it is open to the parties to separate the risk from ownership. For example, the parties may agree that risk will pass sometime after or before the property has passed. The separation of risk from property can be made in the following ways. Firstly, where delivery has been delayed due to fault of seller or the buyer, the goods are at the risk of the party in fault. Secondly, risk and property may be separated by a trade custom. Thirdly, risk and property can be separated by the agreement of the parties.

WHEN DOES PROPERTY IN THE GOODS PASS UNDER THE SALE OF GOODS ACT?

Sections 18 to 25 of Sale of Goods Act lay down the rules which determine when ownership of property passes from the seller to the buyer. These rules may be summarised as follow:

- A. TRANSFER OF PROPERTY IN UNASCERTAINED GOODS

- B. TRANSFER OF PROPERTY IN ASCERTAINED GOODS

- C. TRANSFER OF PROPERTY IN SALE BY APPROVAL

- D. TRANSFER OF PROPERTY WHEN RIGHT OF DISPOSAL IS RESERVED

A. TRANSFER OF PROPERTY IN UNASCERTAINED GOODS

1. When there is a contract for the sale of unascertained goods, property in the goods is not transferred to the buyer unless and until the goods are ascertained. (Sec. 18).

2. How goods are ascertained?

By valid appropriation: Under Section 23(1), in a contract for the sale of unascertained or future goods by description, the property in the goods passes to the buyer when the goods of that description are in a deliverable state are unconditionally appropriated to the contract, either by the seller with the assent of the buyer or by the buyer with the assent of the seller. The goods are ascertained by appropriation. Until appropriation there is merely an agreement to sell. Appropriation means selection of goods with the mutual consent of the parties.

The following are the essentials of appropriation:

- The goods should confirm to the description and quality stated in the contract.

- The goods must be in a deliverable state.

- The goods must be unconditionally (as distinguished from an intention to appropriate) appropriated to the contract either by delivery to buyer or his agent or the carrier.

- The appropriation must be

- by seller with the assent of buyer or.

- by buyer with the assent of seller.

- The assent may be expressed or implied.

- The assent may be given either before or after appropriation.

Thus, if A agrees to sell to B 20 tonnes of oil of a certain description in his cisterns and he has more than 20 tonnes of oil of description in his cisterns, then no property will pass to B unless the 20 tonnes are separated from the rest and they are appropriated to the contract.

Delivery to the carrier [Sec. 23(2)] – When the seller delivers the goods, to a carrier for being taken to the buyer, and does not reserve the right of disposal, the property passes to the buyer. The carrier becomes the agent of the buyer and such a delivery amounts to a delivery to the buyer and the risk is, after the delivery of the buyer. The essentials of delivery to a carrier are—

- Delivery must be in pursuance of the contract Le. the goods must be of the de-scription and quality of the goods contracted.

- Seller delivers goods to the buyer or to a carrier or a bailee for transmission to the buyer. This must be pursuant to the contract,

- Seller does not reserve right of disposal.

B. TRANSFER OF PROPERTY IN ASCERTAINED GOODS

Where there is a contract for the sale of specific or ascertained goods the property in them is transferred to the buyer at such time as the parties to the contract intend it to be transferred [Sec. 19(1)]. For the purpose of ascertaining the intention of the parties regard shall be had to—

- the terms of the contract,

- the conduct of the parties, and

- the circumstances of the case. [Sec. 19(2)]

It is only when the intention of the parties cannot be judged from their contract or conduct or other circumstances that the rules laid dowh in Sections 20 to 24 apply. [Sec. 19(3)]. These rules are as follows:

(a) Specific goods in a deliverable state: [Section 20]

- in case of an unconditional contract for the sale of specific goods in a deliverable state,

- the property in the goods passes to the buyer on making the contract, and

- it is immaterial whether the time of payment of the price or the time of delivery of the goods or both is postponed.

(b) Specific goods to be put in deliverable state: [Section 21]

- where there is a contract for the sale of specific goods and

- the seller is bound to do something to the goods for the purpose of putting them into a deliverable state,

- the property in the goods does not pass until such thing is done and the buyer has the notice thereof.

(c) Specific goods to be Weighed or Measured: [Section 22]

- in a contract for the sale of specific goods in a deliverable state,

- where the seller is bound to weigh, measure, test or do some other act or thing

- with reference to the goods for the purpose of ascertaining the price,

- the property does not pass until such act or thing is done and the buyer has the notice of the same.

C. TRANSFER OF PROPERTY IN SALE BY APPROVAL

When goods are delivered on approval (Sec. 24): When goods are delivered to the buyer on approval or ‘on sale or return,’ or on other similar terms, the property therein passes to the buyer :

- When he signifies his approval or acceptance to the seller, or

- When the buyer does any other act adopting the transaction, e.g., pledges the goods or resells them.

- When the buyer retains the goods, without giving notice of rejection, beyond the time fixed for the return of goods, or if no time has been fixed, beyond a reasonable time. In short, the property passes either by acceptance or by failure to return the goods within specified or reasonable time.

D. TRANSFER OF PROPERTY WHEN RIGHT OF DISPOSAL IS RESERVED

The object of reserving the right of disposal of goods is to secure that the price is paid before the property passes to the buyer. For example, under the VPP (Value Pre Paid) system the ownership passes to the buyer when the price is paid against the delivery of goods, till then the seller retains control over the goods

Section 25(1) lays down that—

in a contract for the sale of specific goods or where goods are subsequently appropriated to the contract,

- the seller may reserve the right of disposal of the goods until certain conditions are fulfilled.

- In such a case, even if the goods are delivered to the buyer himself, or to a carrier or other bailee for transmission to the buyer, the buyer does not acquire ownership until the conditions imposed by the seller are satisfied.

- For example, X sends certain goods by lorry to Y and instructs the lorry driver not to deliver the goods until the price is paid by Y to the lorry driver. The property passes only when the price is paid.

In the following circumstances, the seller is presumed to have reserved the right of disposal:—

(a) By taking a document of title in his own name or his agent’s name. [Sec. 25(2)].

When goods are shipped or delivered to railways for carriage but the document of title le. the bill of lading (in case of carriage of sea) or the railway receipts (in case of carriage by railways) are taken by the seller in his own name or in his agent’s name, the seller is presumed to have reserved the right of disposal. The property passes over to the buyer only when the buyer pays the price in exchange of bill of lading or the railway receipt.

Example : A sold certain bales of paper to B which were to be sent to him by railway. A took the railway receipt in the name of B, and sent them to his own banker to be delivered to B on the payment of the price. Before B paid the price, and received railway receipts, the goods were destroyed by fire. The court held that the seller should suffer the loss as he has reserved the right of disposal and at the time of destruction of bales, their ownership has not been transferred to the buyer – [General Papers Ltd. v. V.P. Mohideen & Bros. AIR 1958 Madras 482.]

(b) When the bills of exchange along with the RR/bill of lading is sent to the buyer. [Sec. 25(3)].

If the goods are delivered to a carrier {Le. the shipping company or railways) and the bill of lading or RR are taken in the name of the buyer. But the seller draws a bill of exchange on the buyer for the price of the goods, and sends the same to the buyer along with the bill of lading or railway receipts to secure the payment of the price. The property in goods does not pass to the buyer until he accepts the bill of exchange or pays the price of the goods. If he retains the goods without accepting the bill of exchange or payment of price the property does not pass.

TRANSFER OF TITLE BY NON-OWNER OR NO ONE CAN GIVE A BETTER TITLE THAN HE HIMSELF HAS

A sale is a contract plus a conveyance. As a conveyance it involves transfer of title of goods from the seller to the buyer. If the seller’s title is defective, the buyer’s title will also be defective. A person can only transfer what he has. No one can transfer a better title to the goods than he himself possesses. This principle is expressed by the Latin phrase, “Nemo dat quad non habet”, which means “none can give who does not himself possess”.

Exceptions

– In each of the following cases, a person who is not an owner, can give to the transferee a valid title to the goods:

1. Transfer of title by estoppel [(Sec. 27)]

When the true owner of the goods by his conduct or words or by any act or omission leads the buyer to believe that the seller is the ownfer of the goods or has the authority to sell them, he cannot afterwards deny the seller’s authority to sell. The buyer in such a case gets a better title than that of the seller.

Example:

- ‘O’ who is the true owner of the goods, causes the buyer ‘B’ to believe that ‘S’ has the authority to sell the goods. ‘O’ cannot afterwards question the seller’s want of title on the goods.

- ‘A’ was the true owner of goods. ‘B’ the seller told the buyer ‘C’ that the goods belonged to him. ‘A’ was present but remained silent. ‘C’ purchased the goods from ‘B’. Can ‘A’ question the title of ‘C’ over the goods?

2. Sale by a mercantile agent [Proviso to Sec. 27]

Sale of goods by a mercantile agent gives a good title to the purchaser even in cases where the agent acts beyond his authority, provided the following conditions are satisfied—

- The agent is in possession of the goods or of a document of title to the goods.

- Such possession is with the consent of the owner.

- The agent sells the goods in the ordinary course business. :

- The purchaser acts in good faith and has no notice that the agent had no authority to sell.

“Mercantile Agent”- ‘Mercantile agent’ means an agent having in the customary course of his business as such agent authority either (1) to sell goods, or (2) to consign goods for the purpose of sale, or (3) to buy goods, or (4) to raise money on the security of goods. [Sec. 2(9)]

Good faith means honestly, whether done negligently or not.

Document of Title to Goods. [Sec. 2(4)]

A document of title to goods is a document representing goods and is used—

- in the ordinary course of business

- as proof of the ownership, possession or control of goods.

It authorises the possessor of such document to receive or transfer the goods represented thereby.

According Sec. 2(4), documents of title to goods includes

- bill of lading

- dock warrant

- warehouse keeper’s certificate

- wharfinger’s certificate

- railway receipt (R/R), lorry receipt (L/R)

- multimodal transport document and

- delivery order.

Thus, document of title is a document, which is the evidence of full ownership of goods represented by the document. Delivery of document of title is as good as giving delivery of goods. Transfer of document of title is a symbolic delivery of goods to the purchaser. The document of title to goods is transferred by endorsement or by mere ’ delivery and it confers a good title to the transferee if he receives it in good faith. E.g. , Delivery of railway receipt is enough to constitute delivery of goods represented by railway receipt.

Document of title shall be distinguished from document showing title to the goods. In case of document showing title to the goods, ownership cannot be transferred by endorsement or mere delivery unlike as in document of title to the goods.

What is bill of lading?

When the goods are carried by sea, the carrier of goods issues to the shipper a bill of lading. It is a document of title. Transfer of goods can be effected by transfer of bill of lading. The buyer may demand delivery of goods at the destination on the basis of the bill of lading.

Wharfingers certificate. A Wharf is a platform alongside the water for loading and unloading a ship. A wharfingers certificate is a document issued by a wharfingers. It certifies that the j goods specified in it are in the wharf. ,

3. Sale by one of several joint owners [Sec. 28]

This section enables a co-owner to sell not only his own share but also of his other co-owners. If one of several joint owners of goods has the sole possession of them by permission of the co-owners, the property in the goods is transferred to any person who buys them from such joint owner provided the buyer acts in good faith and without notice that the seller had no authority to sell.

Section 28 lays down three conditions for validating a sale by one of co-owners :—

- He must be in sole possession by permission of his co-owners.

- The purchaser acts in good faith Le. with honesty.

- The purchaser had no notice at the time of the contract of sale that the seller had no authority to sell.

X, Y & Z own certain truck in common. X is in possession of the truck by permission of his co-owners. X sells the truck to A. A purchases bona fide. The property in the truck is transferred to A.

4. Sale of goods obtained under a voidable agreement [Sec. 29]

When the seller of goods has obtained possession thereof under a voidable agreement but the agreement has not been rescinded at the time of sale, the buyer obtains a good title to the goods, provided he buys them in good faith and without notice of the seller’s defect of title.

It is to be noted that the above section applies when the goods have been obtained under a voidable agreement, not when the goods have been obtained under a void or illegal agreement. If the original agreement is of no legal effect (void ab-initio) the title to the goods remains with the true owner and cannot be passed on to anybody else.

5. Sale by the seller in possession of goods after sale [Sec. 30(1)]

Under this exception, a second sale by the seller remaining in possession of the goods will give a good title to the buyer acting in good faith and without notice. Three conditions should be fulfilled under this exception :

- The seller must continue in possession of the goods or of the documents of title to the goods as seller. Possession as a hirer or bailee of the goods from the buyer after delivery of the goods to him will not do.

- The goods must have been delivered or transferred to the buyer or the documents of title must have been transferred to him.

- Good faith and absence of notice of the previous sale on the part of the second buyer.

6. Sale by buyer in possession of goods over which the seller has some rights [Sec. 30(2)]

This exception deals with the case of a sale by the buyer of goods in which the property has not yet passed to him. When goods are sold subject to some lien or right of the seller (for example for unpaid price) the buyer may pledge, or otherwise dispose of the goods to a third party and give him a good title, provided the following conditions for sell, are satisfied:

- The first buyer is in possession of the goods or of the documents of title to the goods . with the consent of the seller.

- Transfer is by the buyer or by a mercantile agent acting for him.

- The person receiving the same acts in goods faith and without notice of any lien or other right of the original seller.

7. Sale by an unpaid seller [Sec. 54]

An unpaid seller of goods can, under certain circumstances, re-sell the goods. The purchaser of such goods gets a valid title of the goods.

8. Sale under the Contract Act

- A pawnee may sell the goods of pawher if the latter makes a default of his dues. The purchaser under such a sale gets a good title. [Sec. 176 of Contract Act]

- A finder of goods can sell the goods under certain circumstances. The purchaser gets a good title. [Sec. 169 of Contract Act]

- Sale by an Official Receiver of Liquidator of the company will give the purchaser a valid title.

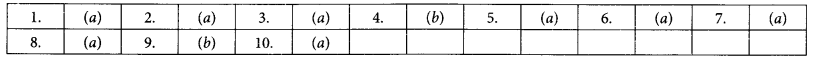

MULTIPLE CHOICE QUESTIONS:

1. Property in the goods ‘in the Sale of Goods Act means’

(a) ownership of goods

(b) possession of goods

(c) asset in the goods

(d) custody of goods

2. It is necessary to determine the precise moment of time at which the ownership of goods passes from seller to the buyer because

(a) risk passes with property

(b) action can be taken only by the owner

( c) suit for price by the seller does not lie unless the property has passed to the buyer

(d) all the above

3. The ownership in specific goods to be put in deliverable state passes—

(a) When the seller has brought the goods into a deliverable state and the buyer has notice thereof

( b) When the goods are brought in deliverable state by the seller

(c) The contract is made

(d) When the intention is clear

4. For passing of property in goods, the goods must be in

(a) deliverable state

(b) manufacturing stage

(c) consumable state

(d) marketing state

5. When the goods are sent on sale or return basis, the property in the goods passes to the buyer:

(a) When the buyer signifies his approval or acceptance to the seller

(b) When the buyer pledges the goods

(c) When the buyer resells the goods

(d) All the above

6. A seller sends the goods and takes the railway receipt in his own name at the buyer’s place the seller has—

(a) Reserved the right of disposal of goods

(b) Not reserved the right of disposal of goods

(c) May reserve the right of disposal of goods

(d) The question of reserving the right of dis-posal does not arise

7. “Nemo dat quad non habet”, means:

(a) no one is greater than god

( b) none can give who does not himself possess

(c) every one can give everything he has

(d) everyone is bound by is habit

8. Sale of goods by a mercantile agent gives a good title to the purchaser even in cases where the agent acts beyond his authority, provided the following conditions are satisfied—

(a) The agent is in possession of the goods or of a document of title to the goods.

(b) The agent sells the goods in the ordinary course business.

(c) The purchaser acts in good faith and has no notice that the agent had no authority to sell.

(d) All the above.

9. For passing of property in respect of specific or ascertained goods, the intention of the parties can be ascertained from —

(a) Terms of the contract

(b) Conduct of the parties

(c) Circumstances of the case

(d) All of the above

10. Under the Sale of Goods Act, 1930, the term “Mercantile Agent” means a mercantile agent, having as such agent, authority to —

(a) sell goods or consign goods for the purposes of sale

( b) buy goods

(c) raise money on the security of goods

(d) do all of the above.

11. Transfer of documents of title to the goods sold to the buyer, amounts to

(a) actual delivery

(b) symbolic delivery

(c) constructive delivery

(d) none of these.

12. A Share Certificate is a —

(a) Document of Title to Goods

(b) Bill of Exchange

(c) Document Showing Title to Goods

(d) Instrument of Transfer

13. A Bill of Lading is a —

(a) Bill of Exchange

(b) Promissory Note

(c) Cheque

(d) Document of Title to Goods.

14. When a bill of exchange in sent together with documents of title, the property in goods passes when the buyer.

(a) Receives the Bill of Exchange

(b) Returns the Bill of Exchange

(c) Accepts the Bill of Exchange

(d) None of these

15. Under the Sale of Goods Act, 1930, “Wharfinger’s Certificate” is a —

(a) Document of Title

(b) Document showing Title

(c) Certificate equivalent to a Negotiable Instrument

(d) Delivery Order

16. Which of these is NOT a Document of Title to Goods?

(a) Bill of Lading

(b) Railway Receipt

(c) Dock Warrant

(d) Bearer Cheque

17. Which of these is NOT a Document of Title to Goods?

(a) Warehouse Keeper’s Certificate

(b) Wharfinger’s Certificate

(c) Bill of Exchange

(d) Dock Warrant

18. Dock Warrant is a—

(a) Document showing title to Goods.

(b) Document of Title to Goods

(c) Bill of Exchange

(d) Warrant for Arrest of a Person

19. For transfer of property in un-ascertained goods, the basic condition is that —

(a) Goods must be ascertained and appropriated.

(b) Goods must be defined by description.

(c) Buyer must receive a sample of the goods

(d) Seller must have produced/purchased the goods

20. The property, in case of sale of un-ascertained goods, passes when—

(a) Delivery Order is entered

(b) Goods are identified and appropriated to the contract

( c) Goods are so far ascertained that the parties have agreed that they shall be taken from some specific larger stock.

(d) Transfer is made in the books of the warehouse man.

21. In case of sale of unascertained goods, the property in goods passes —

(a) when the contract provides that the property in goods shall pass

(b) when the goods are ascertained

(c) when the contract is made

(d) all of the above

22. There was a contract to supply “waste coal and ash for the next six months, as and when the waste is generated by the Seller’s Factory”. The Buyer paid the lumpsum price for the next six months in advance. When does the property in the goods pass to the Buyer?

(a) After the lapse of six months period

(b) At the time of entering into the contract

(c) At the time of paying advance money

(d) As and when the Factory discharges the waste

23. The process of identifying the goods and setting apart as per the intended quality or description is called —

(a) Identification

(b) Procurement

(c) Ascertainment

(d) Allocation

24. In a sale of specific or ascertained goods, the property therein is transferred to the buyer —

(a) upon delivery of goods

(b) upon payment of price

(c) at such time as the parties intend it to he transferred

(d) at such time as decided by the Court.

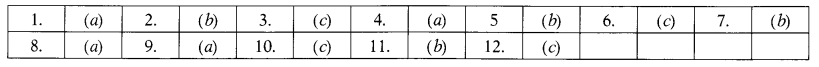

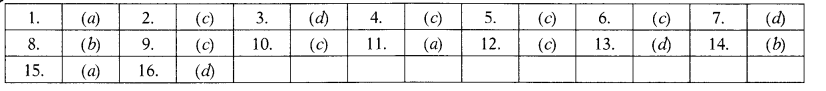

Answers:

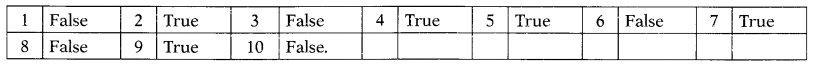

STATE WHETHER THE FOLLOWING ARE TRUE OR FALSE:

1. The general rule of Sale of Goods Act is, risk prima facie passes with the delivery of goods.

2. Risk and ownership cannot be separated.

3. Parties may agree that risk will pass sometimes before the property has passed.

4. Promissory note is a document of title to goods.

5. Pledging of goods obtained under a “sale or return” contract completes the contract of sale.

6. A contract of sale of future goods will always be an agreement to sell.

7. When there is a contract for the sale of un-ascertained goods, the property in the goods is not transferred to the buyer unless and until the goods are ascertained.

8. The seller in possession of the goods after sale can make a valid second sale even if he is not in the possession of the goods or document of title to the goods.

9. A agrees to sell to B 20 tonnes of oil of a certain description in his cisterns and he has more than 20 tonnes of oil of description in his cisterns, then no property will pass to B unless the 20 tonnes are separated from the rest and they are appropriated to the contract.

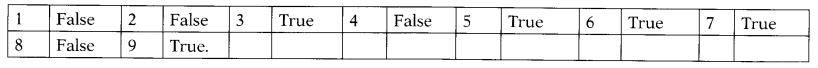

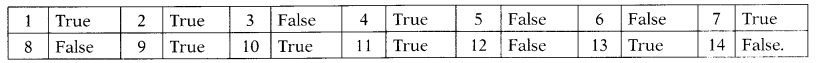

Answers: