Here we are providing Class 12 Accountancy Important Extra Questions and Answers Chapter 8 Financial Statements of a Company. Accountancy Class 12 Important Questions and Answers are the best resource for students which helps in class 12 board exams.

Class 12 Accountancy Chapter 8 Important Extra Questions Financial Statements of a Company

Financial Statements of a Company Important Extra Questions Very Short Answer Type

Question 1.

State the importance of financial analysis for labour unions. (CBSE SP 2019-20)

Answer:

Labor unions analyse the financial statements to assess whether an enterprise can increase their pay.

Question 2.

If operating is not given, what is the time for the operating cycle assumed?

Answer:

12 months.

Question 3.

If the operating cycle is given for 12 months and the payment cycle for trade payables is 15 months, how will you classify the liability?

Answer:

Non-current Liability.

Question 4.

Name any one line item that can be shown under the major heading ‘Equity and Liabilities’ in a company’s Balance Sheet.

Answer:

Shareholders’Funds

Question 5.

Name any one item that can be disclosed under ‘Short Term Provisions’.

Answer:

Provision for Doubtful debts.

Question 6.

How would you treat preliminary expenses?

Answer:

Preliminary expenses are written off in the year in which they are incurred.

Question 7.

Give one example of unamortised expenses.

Answer:

Discount on issue of shares / debentures.

Question 8.

State any one component of shareholders’ funds.

Answer:

Reserves & Surplus.

Question 9.

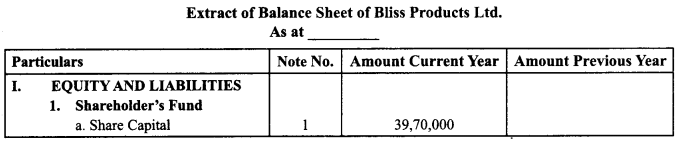

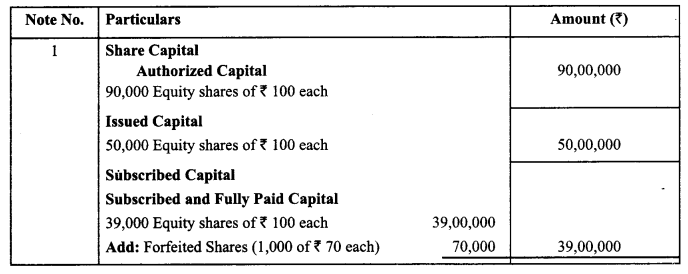

How would you treat share forfeiture account?

Answer:

Added in the subscribed.

Question 10.

Mention one component of Reserves and Surplus.

Answer:

Securities Premium Reserves.

Question 11.

Pratiksha Cartons Limited has given guarantee of ₹ 75,00,000 to a bank for raising loans from the bank by its subsidiary’ company. Where will this be shown in books of the company?

Answer:

This will be mentioned in Notes to Accounts.

Financial Statements of a Company Important Extra Questions Short Answer Type

Question 1.

Explain briefly any four objectives of ‘Analysis of Financial Statements’.

Answer:

Four objective of ‘Analysis of Financial statements are as follows:

- To assess the current profitability and operational efficiency of the firm as a whole as well its different departments so as to judge the financial health of firm.

- To ascertain the financial position of firm.

- To identify the reasons for change in the profitability and financial position of the firm.

- To Judge the ability of the firm to repay its debt and assessing the short-term as well as the long-term liquidity position fo the firm.

Question 2.

State under which major headings and sub-headings will the following items be presented in the Balance

Sheet of a company as per Schedule-Ill, Part-I of the Companies Act, 2013. (CBSE Delhi 2019)

(i) Prepaid Insurance

(ii) Investment in Debentures

(iii) Calls-in-arrears

(iv) Unpaid dividend

(v) Capital Reserve

(vi) Loose Tools

(vii) Capital work-in-progress

(viii) Patents being developed by the company.

Answer:

| Items | Major heads | Sub-heads |

| 1. Prepaid insurance | Current Assets | Other curretn Assets |

| 2. Investment in debenture | Non-current Assets | Non-current investment |

| 3. Calls in Arrears | Shareholders Fund | Subscribed capital (less from subscribe but not fully paid) |

| 4. Unpaid dividend | Current liabilities | Other current liabilities |

| 5. Capital Reserve | Shareholder Fund | Reserve and Surplus |

| 6. Loose tools | Current Assets | Inventories |

| 7. Capital work in progress | Non-current Assets | Fixed Assets (Capital work in progress) |

| 8. Patent being developed by the company | Non-current Assets | Fixed Assets (intangible asset under development |

Question 3.

Under which major heads and sub-heads will the following items be placed in the Balance Sheet of the company as per Schedule III, Part I of the Companies Act, 2013 ? (CBSE Outside Delhi2019)

(i) Cheques and Bank Drafts in Hand

(ii) Loose tools

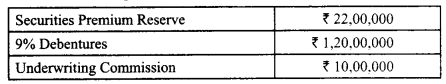

(iii) Securities Premium Reserve

(iv) Long-Term Investments with maturity period less than six months

(v) Work-in-Progress

(vi) Mining Rights

(vii) Publishing titles

(viii) Debtors

Answer:

| Items | Heads | Sub-heads |

| Cheques and Bank Drafts in Hand | Current Assets | Cash & Cash Equivalents |

| Loose Tools | Current Assets | Inventories |

| Securities Premium Reserve | Shareholders’ Funds | Reserves & Surplus |

| Long term Investments with maturity period less than six months | Current Assets | Current Investments |

| Work-in-Progress | Current Assets | Inventories |

| Mining Right | Non Current Assets | Fixed Assets-Intrangible |

| Publishing Titles | Non Current Assets | Fixed Assets-Intangible |

| Debtors | Current Assets | Trade Receivables |

Question 4.

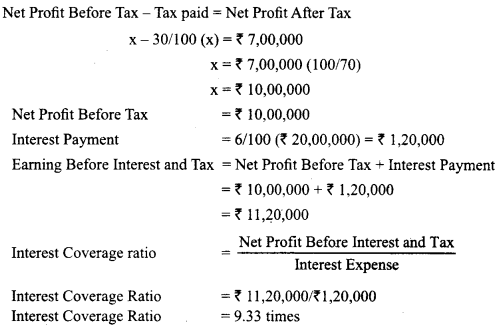

From the following details calculate Interest Coverage Ratio:

Net profit after tax – ₹ 7,00,000

6 % debentures of – ₹ 20,00,000

Tax Rate 30%

Answer:

Question 5.

Under which major heads and sub-heads will the following items be placed in the Balance Sheet of the company as per Schedule III, Part I of the Companies Act, 2013? (CBSE SP2019-20)

(i) Debentures with maturity period in current financial year

(ii) Securities Premium Reserve

(iii) Provident Fund

Answer:

| S. No. | Item | Major Head | Sub Head |

| (i) | Debentures with maturity period in current financial year | Current Liabilities | Other Current Liabilities |

| (ii) | Securities Premium Reserve | Shareholder’s Fund | Reserves and Surplus |

| (iii) | Provident Fund | Non-Current Liabilities | Long Term Provision |

Question 6.

Under which sub-headings will the following items be placed in the Balance Sheet of a company as per Schedule-Ill, Part-I of the Companies Act, 2013? (CBSE Compt.2019)

(i) Prepaid Expenses

(ii) Loose Tools

(iii) Loans Repayable on Demand

(iv) Provision for Employee Benefit

(v) Negative Balance in the Statement of Profit and Loss

(vi) Bank Overdraft

(vii) Bills Receivables

(viii) Trade Marks

Answer:

| Items | Sub-Head | |

| (i) | Prepaid Expenses | Other Current Assets |

| (ii) | Loose Tools | Inventories |

| (iii) | Loans repayable on demand | Short Term borrowings |

| (iv) | Provision for employees benefit | Long term provisions |

| (v) | Negative balance in Statement of Profit and Loss | Reserves and Surplus |

| (vi) | Bank Overdraft | Short Term borrowings |

| (vii) | Bills Receivable | Trade Receivables |

| (viii) | Trade Marks | Fixed assets Intangible |

Question 7.

(a) Classify the following items under Major Head and Sub-Head (if any) in the Balance Sheet of a company as per Schedule III of the Companies Act, 2013.

(i) Capital Work in progress; and

(ii) Provision for warranties.

(b) State any two objectives of ‘Analysis of Financial Statements’. (Compt. Delhi 2017)

Answer:

(i) Classification of items

| S.No. | Items | Headings | Sub-headings |

| (i) | Capital work in progress | Non-current assets | Fixed assets |

| (ii) | Provision for warranties | Non-current liabilities | Long term provisions |

(ii) Objectives of analysis of financial statements

Question 8.

(i) One of the objectives of analysis of financial statement is to ascertain the relative importance of the different components of the financial position of the firm’. State two other objective of this analysis.

(ii) List any four items of ‘reserve’ that are shown under the headings ‘Reserves and Surplus’ in the Balance Sheet of a company as per scheduel III of the Companies Act 2013.

(CBSE Outside Delhi 2016)

Answer:

(i) Objectives of Analysis of Financial Statement:

- Assessing the earning capacity or profitability of the firm as a whole as well as its different departments so as to judge the financial health of the firm.

- Judging the ability of the firm to repay its debts and assessing the short term as well as long term liquidity position of the firm.

(ii) Reserve and Surplus

- Capital Reserve

- Securities Premium Reserve.

- Revaluation Reserve.

- Capital Redemption Reserve.

Question 9.

(i) One of the objectives of ‘financial Statement Analysis, is to identify the reasons for change in the financial position of the enterprise. State two more objectives of this analysis.

(ii) Name any two items that are shown under the head ‘Other Current Liabilities’ and any two items that are shown under the head ‘Other Current Assets’ in the Balance Sheet of a company as per Schedule III of the Companies Act, 2013. (CBSE Outside Delhi 2016)

Answer:

(i) Objectives

- To evaluate the business in Terms of profit in present and future.

- To evaluate the efficiency of various parts or departments of the business.

(ii) Other Current Liability

- Unpaid dividend

- Current maturity of long term debts.

Other Current Assets.

- Discount in issue of debentures (to be written off within 12 months).

- Accrued incomes.

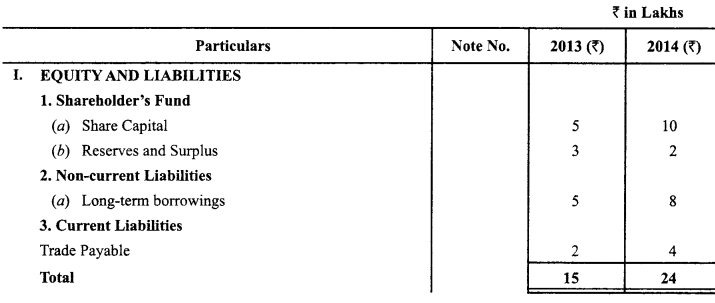

Question 10.

List the major heads under which the ‘Equity and Liabilities’ are presented in the balance sheet of a company as per Schedule III Part I of the Companies Act, 2013. (CBSE Guidance Notes July 2013)

Answer:

The major heads under which ‘Equity and Liabilities’ are presented:

- Share holders Fund

- Share Application Money Pending allotment

- Non-Current liabilities

- Current Liabilities

Question 11.

List the major heads under which the ‘Assets’ are presented in the balance sheet of a company as per Schedule III Part I of the Companies Act, 2013. (CBSE Guidance Notes July 2013)

Answer:

The major heads under which the ‘Assets’ are presented:

(a) Non-current Assets

(b) Current Assets

Question 12.

Name the sub-heads under the head

(a) shareholders Funds’ and

(b) Non-Current Liabilities as per Schedule III Part I of the balance sheet. (CBSE Guidance Notes July 2013)

Answer:

(a) The sub-heads under‘Shareholders Funds’are

- Share Capital

- Reserves and surplus

- Money received against share warrants

(b) The sub-heads under ‘Non-current liabilities’ are

- Long-term Borrowings

- Deferred Tax Liabilities (Net)

- Other Long-term Liabilities

- Long-term Provisions

Question 13.

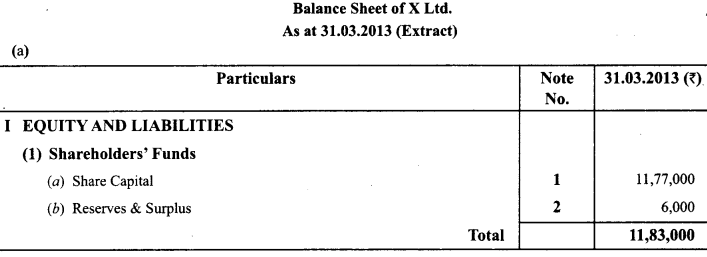

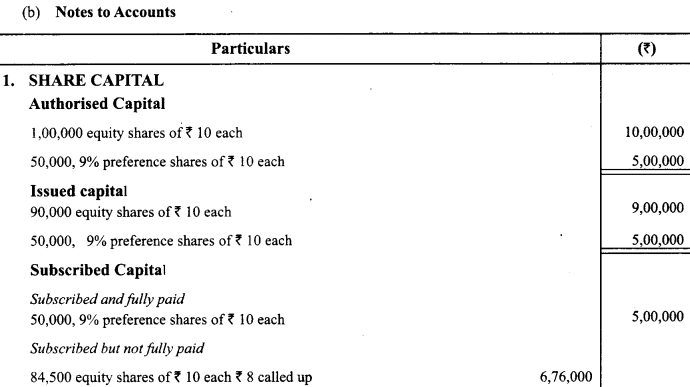

X Ltd. has an authorized capital of₹ 15,00,000 divided into 1,00,000 equity shares of ₹ 10 each and 50,000, 9% preference shares of ₹ 10 each. The company invited applications for all the preference shares but only 90,000 equity shares. All the preference shares were subscribed, called and paid while subscriptions were received for only 85,000 equity shares.

During the first year ₹ 8 per share were called.

Ram holding 1,000 shares and Shyam holding 2,000 shares did not pay first call of ₹ 2.

Shyam’s shares were forfeited after the first call and later on 1,500 of the forfeited shares were reissued at ₹ 6 per shares ₹ 8 called up.

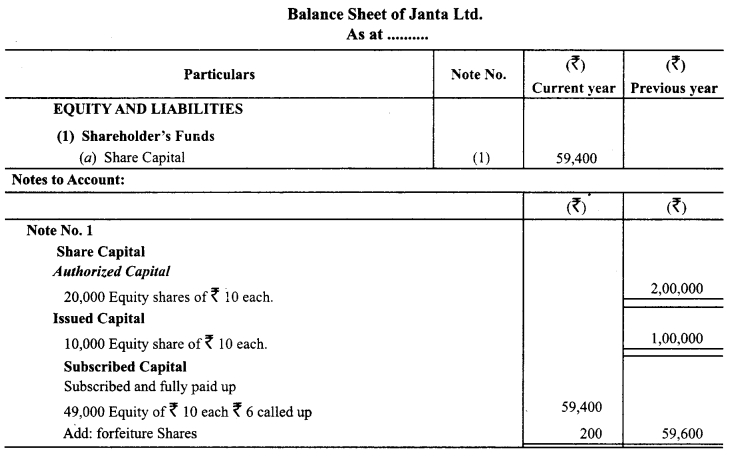

(a) Show share capital in the Balance Sheet as per revised Schedule VI as at 31st March 2013.

(b) Prepare relevant ‘Notes to Accounts’ (CBSE Guidance Notes July 2013)

Answer:

Question 14.

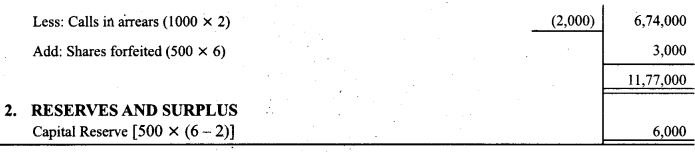

From the following information extracted from the books of XY Ltd., prepare a Balance sheet of the company as at March 31, 2012 as per Schedule III of the Companies Act, 2013.

| Particulars | Amount in ‘000’ (₹) |

| Long-Term Borrowings | 500 |

| Trade Payable | 300 |

| Share Capital | 400 |

| Reserve and surplus | 90 |

| Fixed assets (angible) | 800 |

| Inventories | 20 |

| Trade receivables | 80 |

| Cash and cash equivalents | 120 |

Answer:

Question 15.

JW Ltd was a company manufacturing geysers. As a part of its long term goal for expansions, the company decided to identify the opportunity in rural area. Initial plan was rolled out for Bhiwani village in Haryana. Since, the village did not have regular supply of electricity, the company decided to manufacture solar geysers. The core team consisting of the Regional Managers, Accountant and the Marketing Manager was taken from the Head office and the remaining employee were selected from the village and neighbourhood area. At the time of preparation of financial statement the accountant of the company fell sick and the company deputed a junior accountant temporarily from the village for two months. The Balance Sheet prepared by the junior accountant showed the following items against the Major heads and sub-head mentioned which were not as per Schedule III of the Companies Act 2013. Items Major Head

- Loose Tools Trade Receivable

- Cheque in Hand Current Investment

- Term Loan from Bank Other long Term Liabilities

- Computer Software Tangible Fixed Assets

Present the above items under the correct major head and sub-head as per the Schedule III of Companies Act 2013. (CBSE Delhi 2018)

Answer:

| Item | Heads | Sub-heads |

| Loose Tools | Current assets | Inventories |

| Cheques in hand | Current assets | Cash and Cash Equivalent |

| Term loan from Bank | Non-Current Liabilities | Long Term Borrowings |

| Computer Software | Non-Current assets | Fixed Assets-Intangible Assets |

Question 16.

M K Limited is a computer hardware manufacturing company. While preparing its accounting records it takes into consideration the various accounting principles and maintains transparency. At the end of the accounting year, the company follows the ‘Companies Act, 2013 and Rules there under’ for the preparation of its Financial Statements. It also prepares its Income Statement and Balance Sheet as per the format provided in Schedule III to the Act. Its Financial Statements depict its true & fair financial position. For the financial year ending March 31,2017, the accountant of the company is not certain about the presentation of the following items under relevant Major Heads & Sub Heads, if any, in its Balance Sheet:

- Securities Premium Reserve

- Calls in Advance

- Stores & Spares

Advice the accountant of the company under which Major Heads and Sub Heads, if any, he should present the above items in the Balance Sheet of the company, (CBSE Sample Paper 2017-18, Modified)

Answer:

| S. No. | Items | Major Head | Sub Head |

| (i) | Securities Premium Reserve | Shareholders’ Funds | Reserves & Surplus |

| (ii) | Calls in Advance | Current Liabilities | Other Current Liabilities |

| (iii) | Stores & Spares | Current Assets | Inventory |

Question 17.

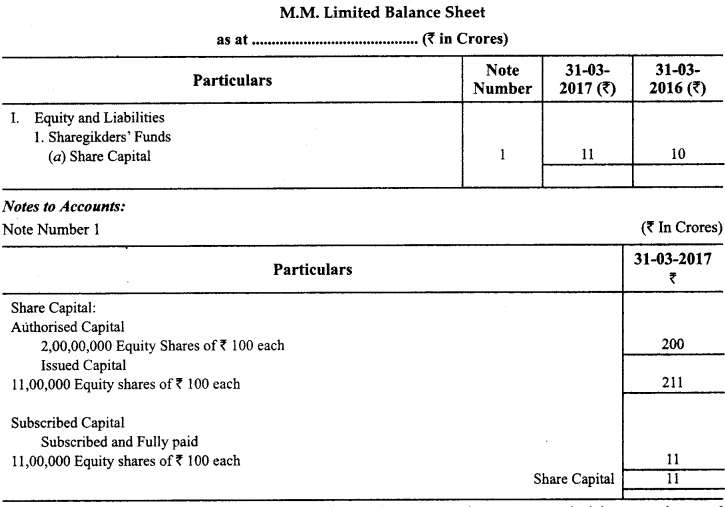

M.M. Limited is registered with an Authorised capital of ₹ 200 Crores divided into equity shares of ₹ 100 each. On 1st April 2016 the Subscribed and Called up capital of the company is ₹ 10,00,00,000. The company decided to help the unemployed youth of the naxal affected areas of Andhra Pradesh, Chhattisgarh and Odisha by opening 100 ‘Skill Development Centres’. The company also decided to provide free medical services to the villagers of these states by starting mobile dispensaries. To meet the capital expenditure of these activities the company further issued 1,00,000 equity shares during financial year 2016-17. These shares were fully subscribed and paid.

Present the share capital of the company in its Balance Sheet. (CBSE Sample Paper 2017-18 Modified)

Answer:

Question 18.

Financial statements are prepared following the consistent accounting concepts, principles, procedures and also the legal environment in which the business organizations operate. These statements are the sources of information on the basis of which conclusions are drawn about the profitability and financial position of a company so that their users can easily understand and use them in their economic decisions in a meaningful way.

State under which major headings and sub-headings the following items will be presented in the balance sheet of a company as per Schedule III of the Companies Act 2013.

- General Reserves,

- Short term loans and advances,

- Capital work in progress and

- Design.

Answer:

| Heads | Sub-head | |

| General Reserves | Shareholders’ Funds | Reserves and Surplus |

| Short term loans and advances | Current assets | – |

| Capital work in progress | Non current assets | Fixed assets |

| Design | Non current assets | Fixed assets/intangible assets |

Question 19.

Mudra Ltd. is in the process of preparing its Balance Sheet as per Schedule III, Part I of the Companies Act, 2013 and provides its true and fair view of the financial position.

(a) Under which head and sub-head will the company show ‘Stores and Spares’ in its Balance Sheet₹

(b) What is the accounting treatment of ‘Stores and Spares’ when the Company will calculate its Inventory Turnover Ratio?

(c) The management of Mudra Ltd. want to analyse its Financial Statements. State any two objectives of such analysis. (CBSE Sample Paper 2016, 2017, Modified)

Answer:

(a) Head: Current Assets Sub head; Inventories

(b) While calculating Inventory Turnover Ratio it is not included in Inventories

(c) Objectives – Assessing the ability of the enterprise to meet its short term and long term commitments, Assessing the earning capacity of the enterprise

Question 20.

(a) Under which major headings and sub-headings the following items will be shown in the Balance Sheet of a company as per Schedule VI, Part I of the Companies Act, 2013.

(i) Bank Overdraft

(ii) Cheques in Hand

(Hi) Loose Tools

(iv) Long term provisions

(b) State any two limitations of Financial Statement Analysis.

Answer:

| S. No. | Items | Headings | Sub Headings |

| 1. | Bank overdraft | Current liabilities | Short term borrowings |

| 2. | Cheques in hand | Current assets | Cash and cash equivalents |

| 3. | Loose Tools | Current assets | Inventories |

| 4. | Long Term Provisions | Non current liabilities | – |

Historical Analysis: Financial statements are based on fast figures. So, we cannot predict about the future accurately.

Ignores price level changes: Financial statements are prepared at the end of year. When these are analysed, values of figures tend to change.

Question 21.

Under which major heads and subheads of the Balance Sheet of a company, will the following items be shown:

(i) Loose Tools

(ii) Retirement Benefits Payable to employees

(iii) Patents

(iv) Interest on Calls in Advance (CBSE Sample Paper 2018-19)

Answer:

| S. No. | Items | Major Head of Balance Sheet | SubHead of Balance Sheet |

| (i) | Loose Tools | Current Assets | Inventories |

| (ii) | Retirement Benefits Payable to employees | Non-Current Liabilities | Long Term Provisions |

| (iii) | Patents | Non-Current Assets | Fixed Asset (Intangible) |

| (iv) | Interest on Calls in Advance | Current Liabilities | Other current Liabilities |

Question 22.

(a) Name the sub-heads under the head ‘Current Liabilities’ in the Equity and Liabilities part of the Balance Sheet as per Schedule III of the Companies Act 2013.

(b) State any two objectives of Financial Statements Analysis. (CBSE Sample Paper 2015)

Answer:

(a) Current Liabilities:

- Short Term Borrowings

- Trade Payables

- Other Current Liabilities

- Short Term Provisions

(b) Objectives of financial statement analysis

- Helps in assessing financial earning capacity of a company

- Helps in assessing managerial efficiency

Question 23.

Name the sub-heads under the head ‘Non-Current Assets’ in the Balance Sheet under Schedule III of the Indian Companies Act, 2013. (CBSE Guidance Notes July 2013)

Answer:

The sub-heads under ‘Non-current assets’ are

- Fixed Assets

- Non-Current Investments

- Deferred Tax Assets (Net)

- Long-term loans and advances

- Other Non-current Assets

Question 24.

Under which major headings and sub-headings the following items will be shown in the Balance Sheet of a company as per Schedule III, Part I of the Companies Act, 2013.

(i) Bank Overdraft

(ii) Cheque in hand

(iii) Loose tools

(iv) Long term provisions

Answer:

| Items | Headings | Sub-headings |

| Bank Overdraft | Current liabilities | Short term borrowings |

| Cheques in hand | Current assets | Cash and cash equivalents |

| Loose Tools | Current assets | Inventories |

| Long Term Provisions | Non-Current liabilities | – |

Question 25.

Under which heads the following items will be placed in the Balance Sheet of a company as per Schedule III Part I of the Companies Act, 2013.

(a) Cash in hand

(b) Mining rights

(c) Short term deposits

(d) Debenture redemption reserve

(e) Income received in advance

(f) Balance in statement of profit and loss

(g) Office equipment

(h) Work in progress (CBSE Delhi 2015)

Answer:

| Items | Major Heads |

| Cash in hand | Current Assets |

| Mining rights | Non Current Assets |

| Short term deposits | Current Assets |

| Debenture redemption reserve | Shareholders’ Funds |

| Income received in advance | Current Liabilities |

| Balance in the statement of profit and loss | Shareholders’ Funds |

| Office equipment | Non Current Assets |

| Work in progress | Current Assets |

Question 26.

Under which headings the following items will be presented in the Balance Sheet of a company as per Schedule III Part I of the Companies Act, 2013₹ [Any four]

(a) Loans provided repayable on demand

(b) Goodwill

(c) Copyrights

(d) Loose tools

(e) Cheques

(f) General reserve

(g) Stock of finished goods and

(h) 9% Debenture repayable after three years

Answer:

| Items | Major Heads |

| Loans provided repayable on demand | Current Liabilities |

| Goodwill | Non Current Assets |

| Copyrights | Non Current Assets |

| Loose tools | Current Assets |

| Cheques | Current Assets |

| General reserve | Shareholders’ Funds |

| Stock of finished goods | Current Assets |

| 9% Debenture repayable after three years | Non current Liabilities |

Question 27.

Under which head the following items will appear in case of financial company₹

(i) Interest Received

(ii) Dividend Received

(iii) Profit and sale of securities

(iv) Loss an sale of plot

(y) Wages paid

(vi) Depreciation on building

Answer:

| Items | Headings |

| Interest Received | Revenue from operations |

| Dividend Received | Revenue from operations |

| Profit and sale of securities | Revenue from operations |

| Loss an sale of plot | Other Income |

| Wages paid | Employee Benefit Expenses |

| Depreciation on building | Depreciation and Administration Expenses |

Question 28.

Under which head the following items will appears in case of non-financial company₹

(i) Sales

(ii) Sale of scrap

(iii) Interest received

(iv) Profit and sale of Investments

(v) Bonus

(vi) Interest paid on loans

(vii) Administration Expenses

(viii) Excess Provision written bank

(ix) Raw Material

(x) Leave encashment

Answer:

| Items | Headings |

| Sales | Revenue from operations |

| Sale of scrap | Revenue from operations |

| Interest received | Other Incomes |

| Profit on sale of Investments | Other Incomes |

| Bonus | Employee benefit Expenses |

| Interest paid on loans | .Finance Cost |

| Administration Expenses | Other Expenses |

| Exam Provision written bank | Other Incomes |

| Raw Material | Cost of Material |

| Leave encashment | Employee benefit Expenses |

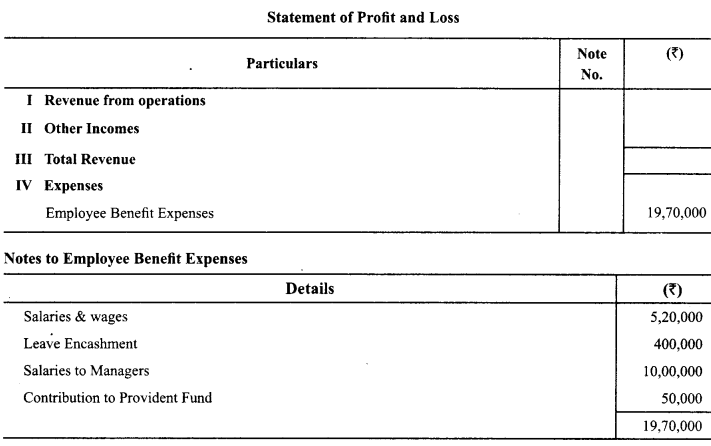

Question 29.

How would you show ‘Employee Benefit Expenses with the help of Notes to Accounts in the Statement of Profit & Loss₹

(i) Salaries & wages ₹ 5,20,000

(ii) Dividend received ₹ 5000,

(iii) Leave encasement ₹ 400,000

(iv) Salaries to manages ₹ 10,00,000

(v) Depreciation on fixed assets ₹ 200,000

(vi) Contribution to provident fund ₹ 5000.

Answer:

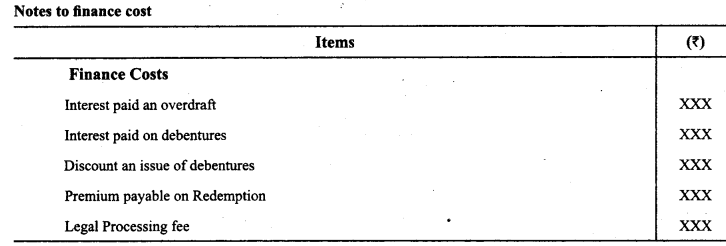

Question 30.

Which of the following items will form the part of Notes to Accounts on Finance Costs₹

(i) Interest paid an overdraft

(ii) Interest paid on debentures

(iii) bank charges

(iv) Discount an issue of debentures

(v) Premium payable an redemption of debentures

(vi) Discount allowed to debtors

(vii) Bad-debts

(viii) Bonus

(ix) Interest Received on fined deposits

(x) Legal processing fee

Answer:

Please note that bank charges are not related to raising finance. So, bank charges, discount allowed to debtors, Bad-debts are the part of finance cost. Interest received is the part of other incomes & bonus is the part of employee benefits expenses.