By going through these CBSE Class 11 Accountancy Notes Chapter 11 Accounts from Incomplete Records, students can recall all the concepts quickly.

Accounts from Incomplete Records Notes Class 11 Accountancy Chapter 11

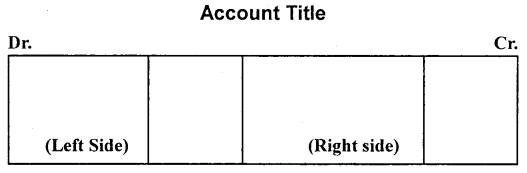

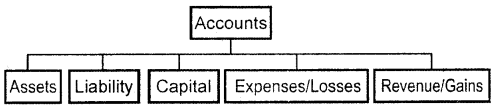

Generally, business transactions are recorded on the basis of the double-entry system of bookkeeping. Sometimes rules of the double-entry system are not followed for recording business transactions. When a double entry system is not followed for maintaining records, these records are turned into incomplete records. Many authors describe it as a Single Entry System.

However, Singe Entry System is a misnomer because there is no such system for maintaining accounting records. It is rather a mechanism of maintaining records in which rules of the double-entry system are not followed completely. There is the partial observance of rules of the double-entry system in this system.

This recording is done according to the convenience and needs of business entities and there is no uniformity in the maintenance of records by different entities. This system differs from concern to concern. In this, only records of cash and of personal accounts are maintained. It is always an incomplete double entry system, varying with circumstances. business, nature of business, prevailing circumstances, etc.; the procedure of recording followed by different business entities may vary’. Therefore, there is no uniformity in the maintenance of records under incomplete records.

→ Suitability: This system is suitable for a sole trader or partnership firms. Companies, because of legal provisions, cannot keep incomplete records.

→ Flexibility: This method is flexible as the recording procedure can be adjusted according to the information needs of a particular business enterprise. As rules of the double-entry system are not followed, knowledge of principles of the double-entry system of bookkeeping is not necessary.

→ Maintenance of Personal Accounts and Cash Book: Under this system mainly the personal and cash-book maintained which mixes up business as well as private transactions.

→ Variation of Recording Process: It is an incomplete double entry system, varying according to the information needs of business entities. There is no hard and fast rule for the maintenance of records under this system.

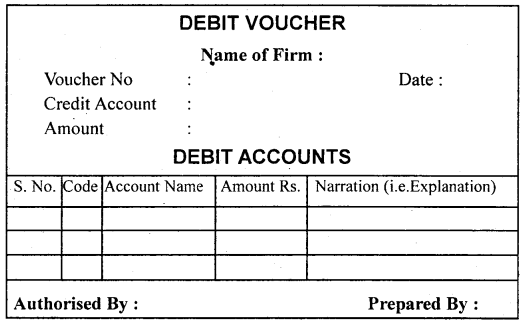

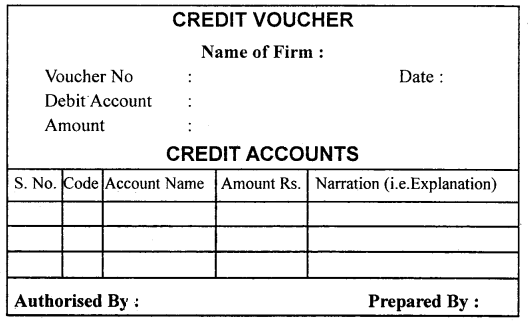

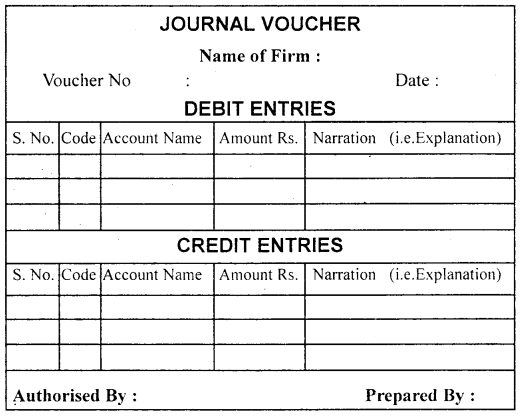

→ Dependence on Original Vouchers: Original vouchers play every important role as they provide all the information to be recorded.

→ Less Expensive: As complete records are not kept, the time and labor involved in maintaining accounting records are less in comparison to double entry.

Incomplete Records contain:

- Both aspects of some of the transactions.

- Only one aspect of some of the transactions.

- No aspect of some of the transactions.

Reasons for Incompleteness:

Accounting records may be incomplete due to any one or more of the following reasons:

- The businessman may be ignorant of the separate legal entity assumption.

- The businessman may be ignorant of the double-entry accounting principle.

- The businessman may not intentionally maintain proper accounts to evade taxation.

- Destruction of the books of accounts due to fire, flood, etc.

Limitations of Che Incomplete Records:

→ Unscientific: The absence of systematic recording of both aspects of a transaction under this, makes it unscientific.

→ No trial balance or arithmetical accuracy of accounts cannot be checked: The dual aspect of a transaction is not recorded under this system. As a result, the trial balance cannot be prepared from the accounting records maintained. Hence, the arithmetical accuracy of accounting records cannot be checked.

→ True profits cannot be known: Nominal accounts are not maintained and therefore it is not possible to prepare a trading account and Profit & Loss Account to calculate gross profit and net profit respectively. Although the amount of net profit is determinable the absence of details of revenue, other income, expenses, and losses affect sound decision making.

→ The finance position cannot be determined: As all the assets and liabilities and depreciation are not recorded, the Balance Sheet cannot be prepared and thus the true financial position cannot be ascertained.

→ Difficult to detect fraud: Trial balance cannot be prepared to check prima facia arithmetical accuracy of accounts. It encourages carelessness, misappropriation, and fraud because, in the absence of complete records, detection of fraud is very difficult.

→ Difficult to make planning and decision making: In the absence of reliable information about nominal and real accounts, effective planning and control over expenses, assets, etc. are not possible.

→ Not recognized by tax authorities: Accounts maintained based on this system are not accepted by sales-tax and income-tax authorities.

→ Interfirm comparison not possible: Because of variation in accounting procedure and rules, comparison of two or more businesses is not possible.

Advantages of Incomplete Records

→ Simple method: It is a very simple method of accounting. It can be maintained by anyone who does not have adequate knowledge of accounting.

→ Less time-consuming: It is less time-consuming since it requires a limited number of books.

→ Less costly: It is less costly because expenses related to the keeping of books are nominal.

→ Suitable-It is suitable for small shopkeepers who do not require an elaborate system of accounting.

Ascertainment of Profit and Loss:

A profit or loss in the case of a Single Entry System can be ascertained by the following two methods:

- Statement of Affairs Method (or Net Worth Method)

- Conversion Method (or Final Account Method).

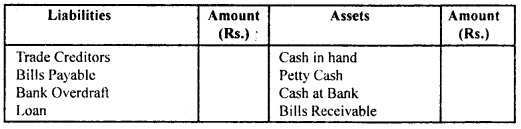

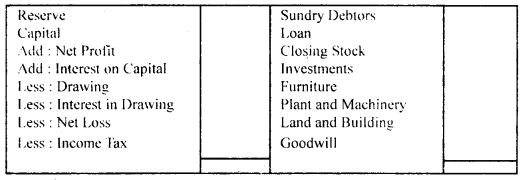

Statement of Affairs Method: A statement of affairs is a statement of assets and liabilities of a business as on a particular date. Under this method, profit is ascertained by comparing the capital at the beginning and capital at the end of the accounting period and necessary adjustments are made for drawings, fresh additional capital, drawings, and interest on capital.

The following steps are followed to ascertain the profit or loss:

1. Prepare a Statement of Affairs at the beginning (if not given) of the accounting period to ascertain the Opening Capital.

2. Ascertain drawings and capital introduced during the year.

3.Prepare a Statement of Affairs at the end of the accounting period to ascertain the Closing Capital (capital at the end) or Prepare a Statement for ascertaining the closing capital before making certain adjustments.

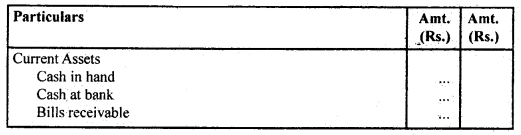

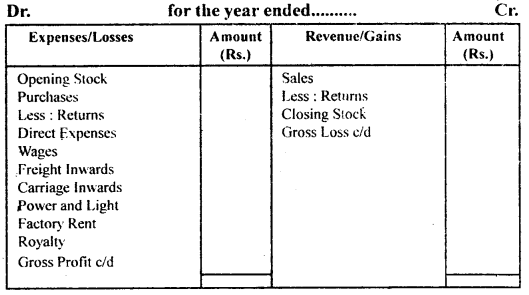

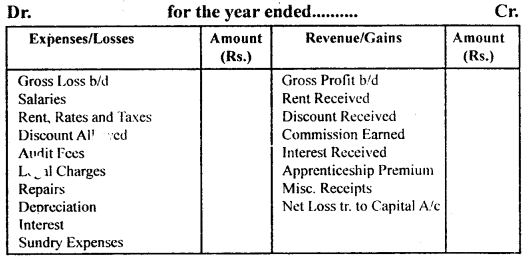

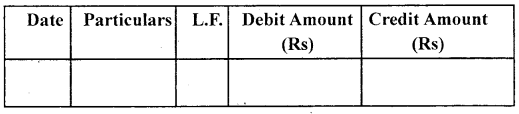

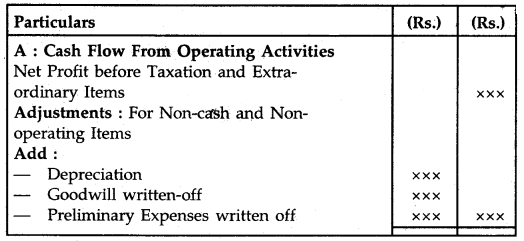

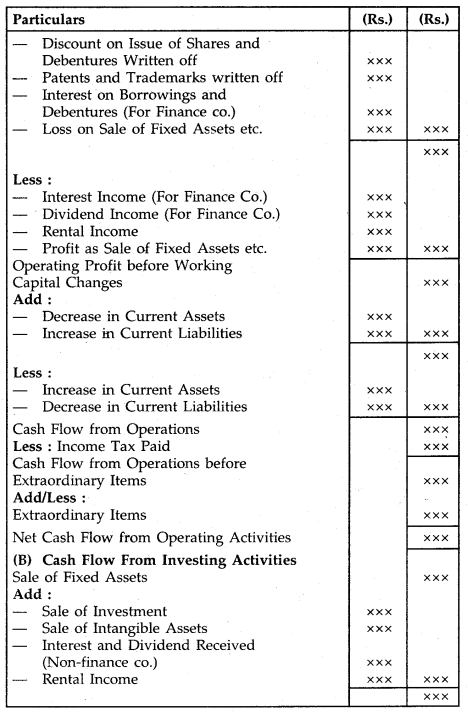

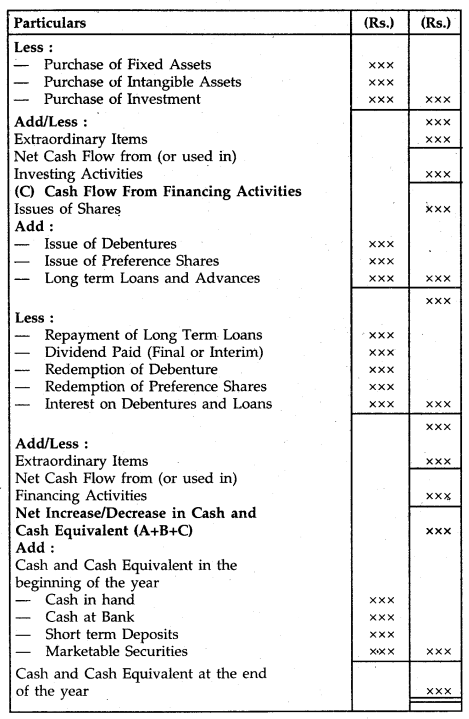

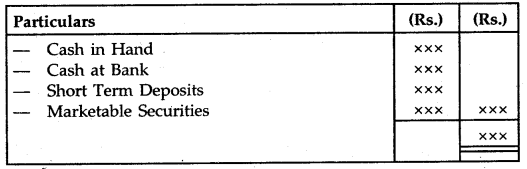

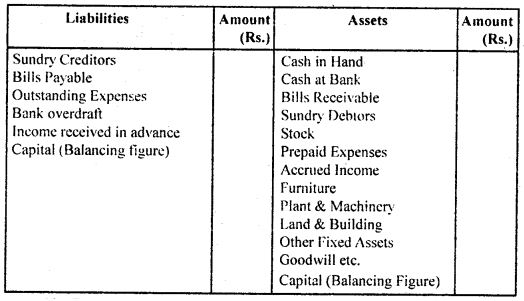

Format of Statement of Affairs Statement of Affairs of…………. as on …………..

4. Prepare a Statement of Profit with the help of the following formula:

Net Profit = Capital at the end Add: Drawings

Less: Additional Capital introduced Less: Opening Capital

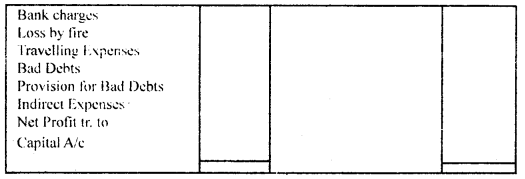

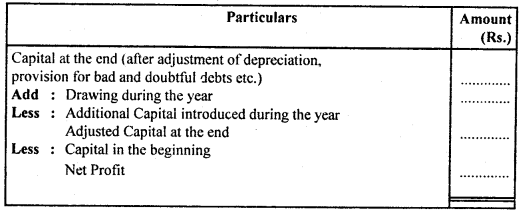

Statement of profit is usually prepared as follows:

Statement of Profit for the year ended ………….

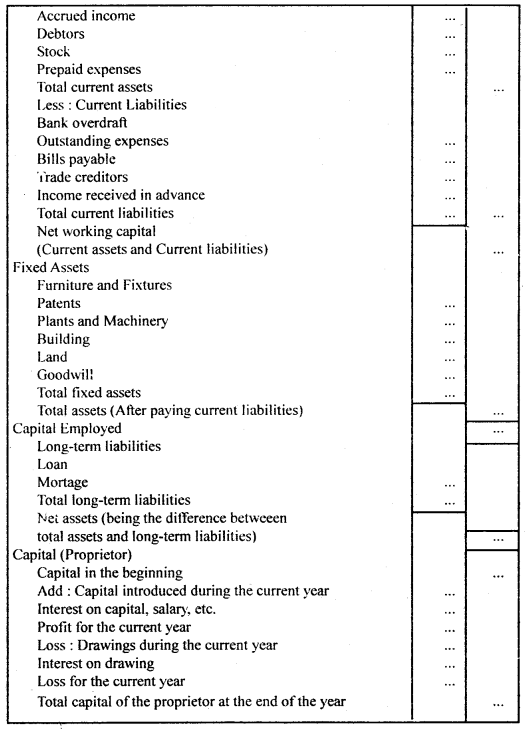

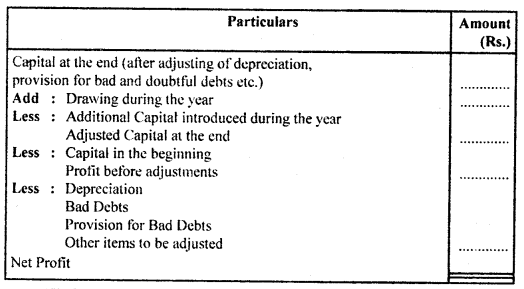

If it is desired to calculate profit before certain adjustments separately the Statement of Profit should be prepared as follows:

Statement of Profit for the year ended……………….

5. Prepare Balance Sheet/Received or Final Statements of Affairs at the end after adjusting depreciation, provision for bad and doubtful debts, etc.

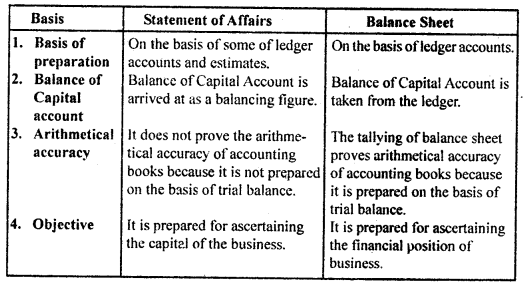

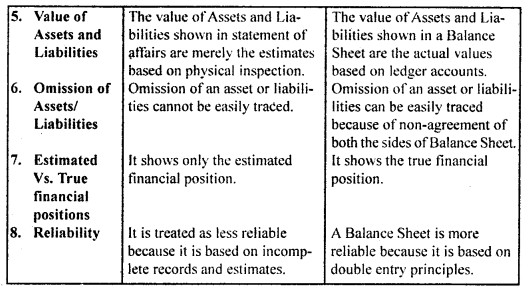

Difference between Balance Sheet and Statement of Affairs:

Calculation of Missing Figures and Prepare Final Accounts:

The following steps are followed while calculating the missing figures and preparation of final accounts:

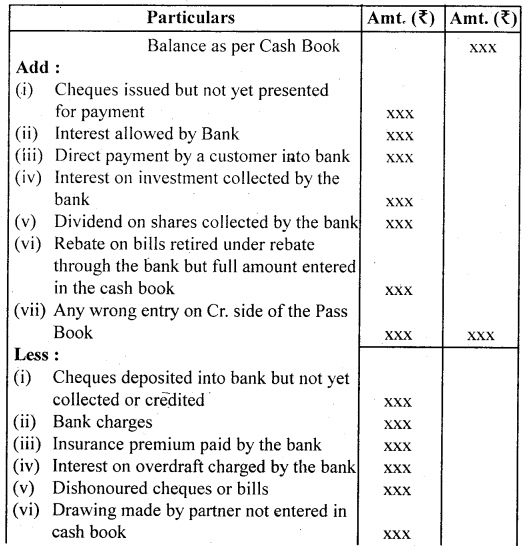

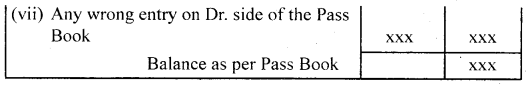

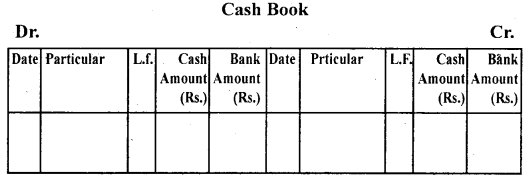

1. Prepare cash and Bank Summary (if not available in proper form with both sides tallied) to ascertain the missing information (Such as opening and closing balances, cash sales/cash purchases, drawing, etc.).

If both the sides of the Cash Book are not tallied, then the difference in both sides may be treated as one of the following items:

If credit sides exceed debit side:

- Opening Cash or Bank Balance or Closing Bank Overdraft

- Cash sales

- Collection from debtors

- Bills Receivable collected

- Additional Capital

- Sale of fixed assets

- Sundry Income.

If debit sides exceed credit side:

- Closing Cash or Bank Balance or Opening Bank Overdraft

- Cash purchases

- Payment to creditors

- Bills Payable discharged

- Drawings

- Purchase of fixed assets

- Sundry expenses

- Cash embezzlement by Cashier.

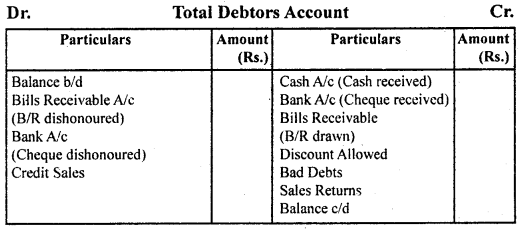

2. Prepare Total Debtors Account to ascertain the missing information (such as opening debtors, closing debtors, credit sales, collections, bills receivable drawn). If both sides of this account are not tallied, then the difference of both the sides may be treated as one of the following items:

If the credit side exceeds the debit side:

- Opening Debtors

- Credit Sales

- Bills receivable dishonored

If the debit side exceeds the credit side:

- Closing Debtors

- Collection from debtors

- Bills receivable drawn

- Sales Returns

- Discount allowed

- Bad debts.

Format of Total Debtors Account

Important: Provision for Doubtful Debts, Provision for Discount on Debtors, Bad Debts Recovered, Trade Discount Allowed, Bills Receivable Discounted do not affect the Total Debtors Account.

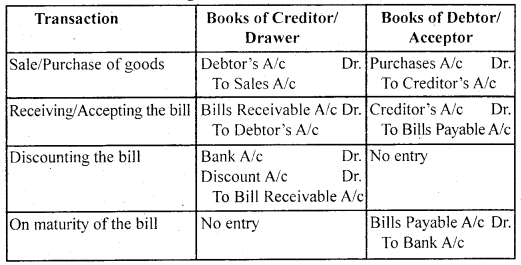

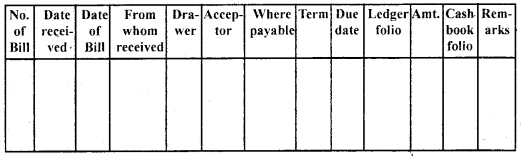

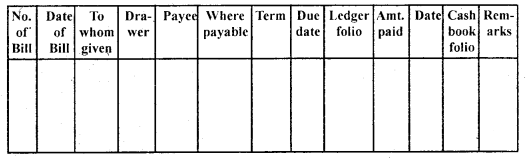

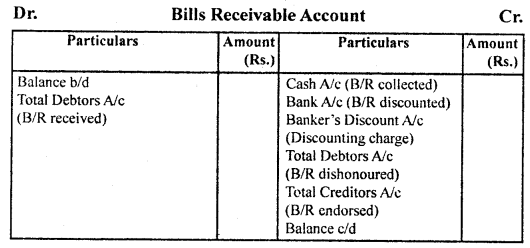

3. Prepare Bills Receivable Account to ascertain the missing information (such as Opening B/R, Closing B/R, B/R drawn, B/R collection, B/R endorsed).

If both the sides of this account are not tallied then the difference in both the sides may be treated as one of the following items:

If the credit side exceeds the debit side:

- Opening B/R

- B/R drawn

If the debit side exceeds the credit side:

- Closing B/R

- B/R collected

- B/R dishonored

- B/R discounted

- Banker’s discount charges

- B/R endorsed

Format of Bills Receivable Account

Important: Provision for Doubtful Bills does not affect the Bill Receivable Account

4. Prepare Total Creditors Account to ascertain the missing information (such as Opening Creditors, Closing Creditors, Credit Purchases, Payment made, B/P accepted).

If both the sides of this account are not tallied, then the difference in both the sides may be treated as one of the following items:

If the credit side exceeds the debit side:

- Closing Creditors

- Payment to Creditors

- B/P accepted

- B/R endorsed to creditors

- Purchase Return

- Discount Received.

If the debit side exceeds the credit side:

- Opening Creditors

- Credit Purchases

- B/P canceled

- Endorsed B/R Dishonoured.

Format of Total Creditors Account

Important: Reserve for Discount on Creditors does not affect the Total Creditors Account.

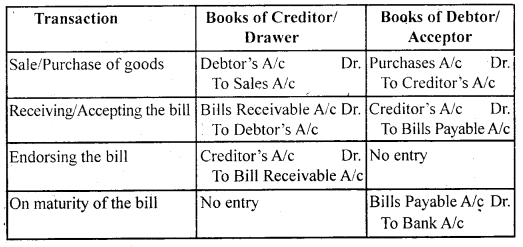

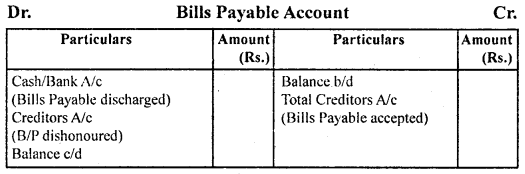

5. Prepare Bills Payable Account to ascertain the missing information (such as Opening B/P, Closing B/P, B/P accepted, B/P discharged). If both the sides of this account are not tallied, then the difference in both sides may be treated as one of the following items:

If the credit side exceeds the debit side:

- Closing B/P

- B/P discharged/canceled.

If the debit side exceeds the credit side:

- Opening B/P

- B/P accepted.

Format of Bills Payable Account:

6. Ascertain opening capital by preparing the statement of affairs at the beginning of the accounting period.

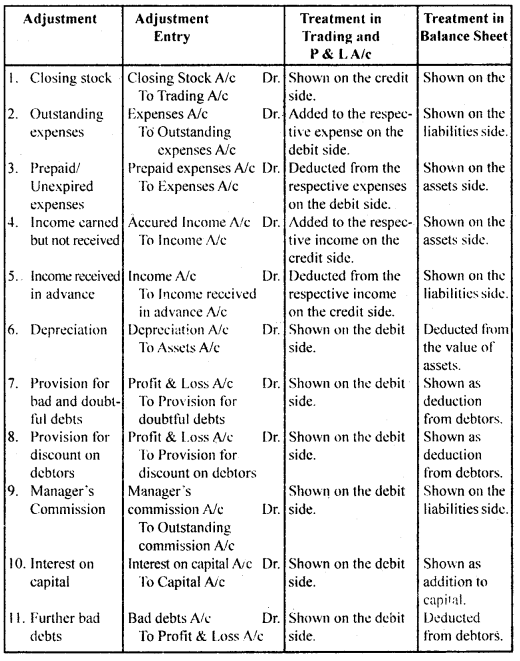

7. Prepare the Trial Balance to check the authentical accuracy.

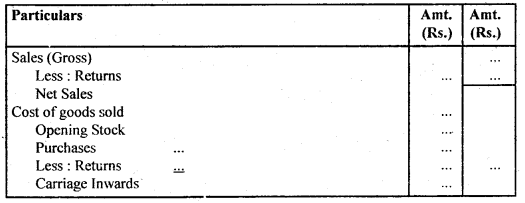

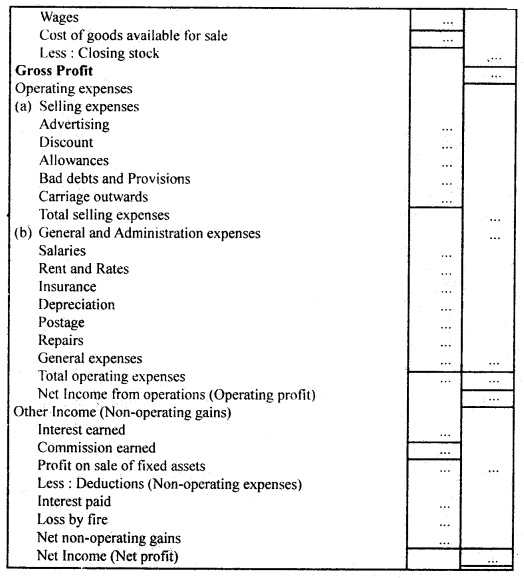

8. Prepare Trading and Profit & Loss Account and the Balance Sheet.