Here we are providing Class 12 Business Studies Important Extra Questions and Answers Chapter 12 Consumer Protection. Business Studies Class 12 Important Questions are the best resource for students which helps in class 12 board exams.

Class 12 Business Studies Chapter 12 Important Extra Questions Consumer Protection

Consumer Protection Important Extra Questions Short Answer Type

Question 1.

What is the provision regarding enforcement of the orders of District Forum, State Commission, or National Commission?

Answer:

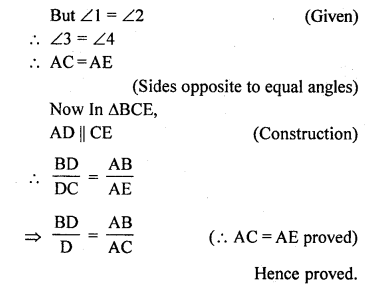

Following are the provision regarding enforcement of orders of redressal agencies

1. Every order of (Redressal Forum, the Agency Commission, or National Commission) shall be a bind if no appeal has been preferred against such order under the provision of this Act.

2. No redressal agency shall admit a complaint unless it is filed within 2 years from the date on which the cause of action has arisen (sec. 24 A (1)).

3. A complaint may be entertained for the period specified above If the complaint satisfies that he had sufficient cause for not filing the complaint within such period [Sec. 24 A (2)].

It is worth mentioning that such delay can be condoned only when the reasons are recorded.

4. Every order made by such agency will be executed in the same way as the court, to which it is sent, shall execute as if it were decree or order sent to it for execution. (Sec. 25).

5. If the redressal agency fails to get its order executed, then it will send the order to the court in whose jurisdiction the dispute falls for its execution. Then the said court shall execute the order as if it were a decree or order sent to it for execution.

Jurisdiction is decided as under:

- If the order is against a company, the jurisdiction will be divided on the basis of the place of the registered office of the company.

- If the order is against any person, the jurisdiction will be decided according to the place where the person concerned voluntary resides or carries on business, or personally works for gain (Sec. 25)

6. When a complaint is put up before these agencies it is found to be frivolous or vexatious, it shall, for a reason to be recorded in writing, dismiss the complaint.

It can also be made an order that the complaint shall pay to the opposite party such cost, not exceeding ten thousand rupees, as may be specified in the order.

Question 2.

What are the Penal Provision under Consumer Protection Act?

Answer:

According to Sec. 27, where a trader or a person against whom a complaint is made, or the complainant, fails to comply with any order made by the District Forum, the State Commission, or National Commission, as the case may be, such traders or person or complainant shall be punishable

- with imprisonment for not less than one month but which may extend to 3 yrs; or

- with fine which shall be not less than Rs. 2000 but which may extend to Rs. 10,000; or

- with both.

In case, the redressal agency is satisfied with the circumstances of the case, it can reduce the minimum limits of both imprisonment or fine, mentioned above.

Consumer Protection Important Extra Questions Long Answer Type

Question 1.

What are various prescribed authorities under the consumer protection Act, 1986? Describe their composition, object, and procedure for the meeting.

Answer:

Authorities under the Act as follows:

1. The Central Consumer Protecting Council (Sec. 4 (1)): This section provides provision for the establishment of the Central Consumer Protection Council (now Central Council) by the Central Government. The Central Government may issue a notification in this regard and may specify the date of establishment of such council in the notification.

Composition (Sec. 4(2)): The Central Council shall consist of the following members

- The Minister-in-Charge of consumer affairs in Central Government, who shall be its chairman, and

- Such member of other official or non-official members as may be prescribed.

- The Minister of State of Consumer Affairs in Central Government as Vice-Chairman of Council;

- The Minister of Food and Civil Supplies or Minister-in-Charge of Consumer Affairs in State;

- 5 members from Lok Sabha and 3 members from Rajya Sabha.

- The Secretary of National Commission for Scheduled Castes and Scheduled Tribes;

- Up to 20 representatives of the Central Government Department and autonomous organization concerned with consumer interest;

- At least 35 representatives of the Consumer Organisation concerned with consumer interest.

- not less than 10 representatives of women.

- Up to 20 representatives of farmers, trade, and industries.

- The Secretary in Department of Civil Supplies shall be the Member Secretary of Central Council.

The object of Central Council (Sec. 6)The Central Council shall work with the objective to promote and protect the rights of consumers.

Terms of CouncilTerm of Council shall be 3 years. A member may resign by submitting his written resignation to the chairman, the vacancies shall be filled from the same category by the Central govt, and such person shall hold office so long as the original member would have been entitled to hold office. The Central govt may constitute a standing working group from amongst the member of the council to monitor the implementation of the recommendation of the council.

Procedure for Meeting of Central Council (Sec. 5) The council shall meet as and when necessary, but at least one meeting of the council shall be held every year. The meeting shall be held at such place and at such time as the chairman may think fit.

2. The State Consumer Protection Council (Sec 7(1))This section authorizes the State Government to establish a Consumer Protection council by issuing a notification in this regard and with effect from such date as it may specify in the notification.

Composition Sec 7 (2): The State Council shall consist of the following members

- The Minister-in-Charge of Consumer Affairs in State Government as its chairman.

- Such member of other official or non-official members, representing various interest, as may be prescribed by State Government; and

- Up to 10 other official or non-official member nominated Objects of Council (Sec. 8) The objective of every state council shall be to promote and protect the rights of consumers as laid down in clauses (i) to (v) of section 6 within the state.

The procedure of Meeting (Sec 7 (4)): The State Council shall meet as and when necessary, but at least 2 meetings should be held every year. It shall meet at such time and place as the Chairman may think fit and observe such procedure which is prescribed by State Government for the transaction of its business.

3. The District Consumer Protection Council (Sec 8 A): This section was inserted in 2002 in Act by making amendment in it. ACU to the Section, the State Govt, shall establish District Consumer Protection Council for every district with effect from such date as is specified in the notification.

Composition: The District Council shall consist of the following members:

- the Collector or Deputy Commissioner as its chairman; and

- such member of other official or non-official members representing such interest as may be prescribed by State Government.

The object of Council (Sec. 8B): The District Council shall work with the objective of promoting and protecting the rights as specified in clauses (i) to (vi) of sec. 6 with the jurisdiction of the district.

Procedure for MeetingThe District Council shall meet as and when necessary, but at least 2 meetings should be held every yr. It shall meet at such time and place as the Chairman may think fit and observe such procedure which is prescribed by State Govt, for the transaction of its business.

Question 2.

Define the following terms

Answer:

(a) Consumer: Acc. to Consumer Protection Act, 1986, ‘Consumer’ means a person who:

1. Buys any goods for the consideration which has been paid or promised or partly paid and partly promised, or under any system of deferred payment and includes any user of such goods other than the person who buys goods for consideration paid or promised or under any system of deferred payment, when such use is made with the approval of such person, but does not include a person who obtains such goods for resale or for any commercial purpose or, (Sec 2(l) d 0).

2. Hires of avails of any services for a consideration which has been paid or promised or partly paid or promised, or under any system of deferred payment and includes any beneficiary of such services other than the person who hires or avails of services for consideration paid or promised, or under any system of deferred payment, when such services are availed of with the approval of the first-mentioned person.

Explanation Please note that the consumer also includes the user of goods or beneficiary of services when such goods or services are used or availed with the permission of the main buyer.

Also, the consumer does not include a person who uses the goods or services for the purpose of resale or any other commercial purpose.

But note that, ‘commercial purpose’ doesn’t include used by him exclusively for the purpose of earning his livelihood, by means of self-employment.

(b) Complaint ‘Complaint’ means any allegation in writing made by a complainant that:

- an unfair trade practice or a restrictive trade practice has been adopted by any trader;

- the goods, brought by him or agreed to be brought by him, suffer from one or more defects;

- the services, hired or availed of or agreed to be hired or availed of by him, suffer from a deficiency in any respect;

- A trader has charged for the goods, mentioned in the complaint, a price in excess of the price fixed by or under any law for time being in forces or displayed on the goods or any package containing such goods.

- Goods, which will be hazardous to life and safety when used, are being offered for sale to the public in contravention of permission of any law for time; being in forces requiring traders to display information in regards to contents, manner, and effect of the use of such goods (sec 2 (1) (c)).

(c) ComplainantAny person or institute mentioned below who files a complaint is called the complainant

- A consumer or

- Any voluntary consumer association registered under the Indian Companies Act, 1956 or any Voluntary Consumer Association registered under other Act in force in the country.

- The Central or State govt., who or which makes a complaint.

- In the case of numerous consumers having the same interest, one or more than one consumer.

- In case of death of a consumer, his legal heir or representative, who or which makes a complaint (Sec 2(1) (b)).

(d) ManufacturerIt means the person who:

- makes or manufacture any goods or parts thereof,

- does not makes or manufacture any goods but assemble parts thereof made or manufactured by others and claims the end-product to the goods manufactured by himself, or

- puts or causes to be put his own mark on any goods to be made or manufactured by, any other manufacturer and claims such goods to be made or manufactured by himself (sec 2(i)).

Explanation Where a manufacturer dispatches any goods or part thereof no any branch office maintained by him, such branch shall not be deemed* to be manufactured even though the parts so dispatched to it as assembled at such office and are sold or distributed from such branch office.

Question 3.

What is the need and importance of the consumer protection Act in India?

Answer:

Need and Importance of Consumer Protection Act can be explained as follows:

1. Unfair and Deceptive Trade Practices: In case of unfair and deceptive trade practices, such as selling of defective or sub-standard goods, ignoring safety standards, charging exorbitant prices, misrepresenting the efficiency or usefulness of goods, etc. Consumer Protection Act makes producers/traders more accountable to consumers. It also becomes inevitable for consumers to unite at a common platform to deal with issues concerning consumer protection.

2. Lengthy Legal Process: The violation of various Acts by traders/producers means an ordinary consumer has no other remedy but to initiate action by way of a civil suit which involves a lengthy legal process proving to be too expensive and time-consuming. In fact, very often the time, cost, and mental tension involved in the legal process is disproportionate to compensation claimed and actually granted to individual consumers. Therefore, it becomes necessary to involve laws directed at protecting the consumers providing for remedies that are simpler, more accessible, quicker, and less expensive.

3. Impact of other countries: the USA, European Union, Australia, etc. have taken effective and strict measures to protect the interest of consumers. Following these countries, India has also felt the necessity of consumer’s protection.

4. Welfare State India is a welfare state: One of the Directive Principles enshrined in the Indian Constitution is that state shall direct its policy towards securing that operation of economic system does not result in the concentration of wealth and means of production to determinantal to common man-keeping in view the consumer interest, Govt, passed Monopolies and Restrictive Trade, Practices Act, 1969. Later on, in 1984, provisions relating to unfair trade practices were also incorporated in Act. wide powers have been granted to the HRTP commission under the Act to control and prohibit monopolistic, restrictive, and unfair trade practices.

5. Economic DevelopmentDuring 55 years of planning in India, there is a spectacular change in the standards of living. The structural and institutional changes in the economy consequent upon Economic Reforms 1991 clearly indicate that there has been modernization and globalization of the economy wants of the consumers have increased manifold. Hence, the need for safeguarding consumer’s interests has also grown and has become more important.

6. Means of transport and communication: The rapid growth of means of transport and communication has brought the world consumers together. There is a strong ‘demonstration effect’ through Mass media of TV/ cable network that has made the consumers aware that they can no longer be exploited by the business community and kept isolated from other countries as far as their right to safety and health are concerned.

7. Role of Judicial System: Consumer Protection Act, 1986 has vested vast powers to t Supreme Court for the protection of consumer rights, their safety, and health. As a breakthrough, the remedies for consumer protection are now simpler, more accessible, quicker, and less; expensive.

8. LokAdalats: The concept of Lok Adalat in India is catching up fast. They have become part of a speedy, effective, and economical redressal system. Interesting to note, lakhs of cases relating to motor accidents, complaints diagrams Ltd. Delhi Electric Supply Undertaking have been settled involving crores of rupees. The concept of Lok Adalats has now been extended to other areas.

9. Concept of Public Interest Litigation (PIL): For consumer protection, a large number of petitions by way of PIL have been filed before High Courts and Supreme Court. The concept of PIL is catching fast. Under PIL, it is not only the aggrieved person, but any person can move to court in the interest of the weak or a group who or which may not be in a position to seek legal remedy on his own. ” Secondly, a complaint sent to Supreme Court even on postcard may be treated as a writ petition. PIL is virtually consumer interest litigation which has helped a lot in the cause of consumer protection.

10. Consumer Awareness: The spread of education especially higher education has made people aware of their rights as consumers. The relief granted to consumers and important judicial decisions regarding consumer protection or relief is often covered by, newspaper. Rising income has increased the purchasing power of people to spend more. The rise in prices of products has created in consumer an attitude to expect better quality or. at least to expect the product to be worth their money. Consumers expect better services for their durables. Legislation leading to consumer protection has created an awareness among consumers about their rights and remedies available to them.

11. Consumer organizations: There are more than 500 consumer organizations in India. These consumer organizations are performing a number of functions such as bringing out vouchers, journals, monographs, collecting data of different talks, seminars, workshops, and conferences for the purpose of focusing on the problems of consumers and finding solutions thereof.

Question 4.

Explain the problems of consumers under the Consumer Protection Act.

Answer:

Due to illiteracy, poverty, lack of information, etc. consumers has to face many problems every day. They tolerate silently all these because their outlook being traditional, They remain ignorant of their rights. Following are the problems under the Consumers Protection Act

1. Unfair Trade Practices Trade communities are engaged in various activities to increase their sale and change their economic use or to provide some services. They may devise any unfair method viz. false and misleading advertisement, free gifts, lucky draws. They falsely represent that the services are of particular quality or grade. Following are the unfair trade practice.

(a) False and misleading Advertisement: Trade community spends a lot of money on the advertisement of their goods and services but most of these are false and misleading. These are exaggerated and based on unprovable claims. They make advertisement of products of poor quality’s special standard product.

(b) Free gifts and Prizes: The offering of gifts, prizes, or other items with the intention of the net providing there as offered or creating an impression that something is being given or offered free of charge when it is fully or partly covered by the amount charged in the transaction as a whole is treated as unfair trade practice.

2. Spiralling price: The prices of the product are unduly hiked by the {froducers. The rising prices are the result of anti-social activities viz hoarding, black marketing, and creating of artificial scarcity of the product. It leads to consumer exploitation and victimization.

3. Adulteration It is a big consumer problem. Sometimes, it is very hazardous to health. The traders resort to many sources to earn high profits. Mixing animal fat with ghee, harmful seeds with grains and pulses, mustard oil with mineral oil are some of the adulterations.

4. Poor quality products Sale of poor quality products and sub-standard products is also a part of consumer exploitation. The manufacturer makes the declaration that the product is ‘Agmark’ is not sufficient. There is no matter missing to verify that the goods sold to consumers conform with a specification of safety. It results in a large number of the death by using sub-standard products and unsafe domestic products like a pressure-cooker, kerosene stoves, etc.

5. Deceptive packing Many times traders resort to practicing to deceive consumers. They put the smaller quantity of products in a packet or change the spelling of reputed product slightly like Tata Teas, the name ‘Tata Tea’ etc.

6. Underweight supplies Underweighfgoods by the trader to the consumer, For example, each LPG cylinder must contain 14.2 kgs. of gas but many times under-weight cylinders are supplied to customers.

7. Deficiency in Services Deficiency in Services is also a form of customer problem for instance

- Under delay in courier service

- wrong billing by electricity and telephone departments

- under delay in setting insurance accident claims.

8. Negligence in services It is another cause of consumer exploitation, For instance, wrong operations by a surgeon. Many of these incidents are published in newspapers very often.

9. Monpoloistic trade practices Monopolistic is that market condition in which there is a single seller of a certain product in the market so he is in the position to exploit the consumer by charging high prices and low quality of product etc.

Question 5.

What is the redressal machinery for consumer disputes given in Consumer Protection Act, 1986? %

Answer:

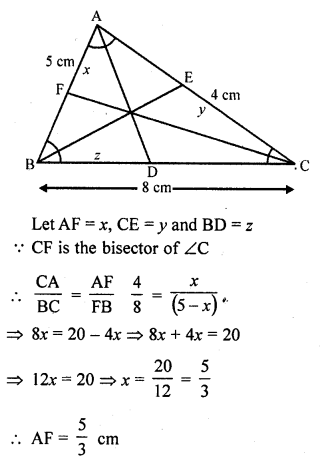

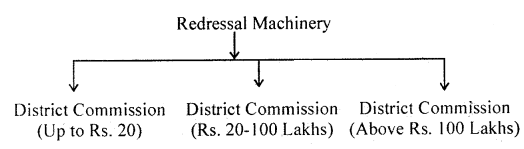

The Act provides for three-tier Quasi-Judicial redressal machinery at District, State, and National Levels for redressal of consumer disputes and grievances. The District Forum has jurisdiction to entertain complaints where the value of goods and services complained against is less than Rs. 20 lakhs; the States Commission for claims between Rs. 20 Lakhs and Rs.100 Lakhs; and the National Commission for claims exceeding Rs. 100 Lakhs.

1. District Commission: Section 9 (a) of the Act provides for the establishment of a District Forum by the State Government for each district of the state by notification. The State Government may establish more than one District Forum if it deems fit to do so.

- Composition (sec. 10(1)): (a) The Collector of the District will be its president.

- Two or more members including at least one woman member, are the persons of ability, integrity, and standing.

- They are appointed by the State Government on the recommendations of the selection committee, on the terms and conditions, salary, or honorarium, and allowances whatsoever.

The selection committee shall consist of the following, namely:

- The President of the State Commission – Chairman

- Secretary, Law Department of the State – Member

- Secretary-in-Charge of the department dealing with consumer affairs in the State member.

Every member of the District Forum will hold office for 5 years or till the completion of 65 years of age, whichever is earlier and shall be eligible for re-appointment. The members should have adequate knowledge and experience to solve the problems relating to economic, law, commerce, accountancy, industry, public affairs, and administration.

Jurisdiction (Sec. 11 ): District forum has:

(a) Pecuniary Limits Under the pecuniary limits of the district, the forum can entertain complaints up to the dispute of Rs. 20 Lakhs only.

(b) Territorial Limits Under the territorial limits, a complaint shall be constituted in the District forum within the territorial jurisdiction wherein the opposite party resides or carries business or has a branch office or any course of action arises wholly or in part.

The manner in which complaint shall be made (Sec 12): A complaint in relation to any goods sold or delivered or agreed, to be sold or delivered or any service provided or agreed to be provided may be filed with a district forum by

- The consumer to whom such goods are sold or delivered or, agreed to be delivered or such service provided or agreed to be provided;

- Any recognized consumer association whether the consumer to whom the goods sold or delivered.

- One or more consumers, where there are numerous consumers having the same interest, with the permission of the District Forum, on behalf of, or for the benefit of, all consumers so interested; or

- The Central or the State Government.

The procedure of Admission of Complaint (Sec 13):

(a) The district forum on receipt of a complaint shall refer a copy of the complaint within 21 days from the date of its admission to the opposite party mentioned in the complaint asking him to give his version within a period of 30 days which can be extended further for 15 days. If the opposite party denies the charges leveled against him, then the District Forum shall settle the consumer dispute in the mariner specified in clause (c) to (9) of .the Section 13.

(b) If the complaint received by it under section 12 relates to goods in respect of which the procedure specified in clauses (c) to (g) sub-section 1 of section 13 cannot be followed, or if the complaint relates to any services, then the district forum shall 1 proceed to settle the dispute on the basis of evidence brought to its notice by the complainant and the opposite party or on the evidence of complainant only if the opposite party omits or fails to take any action.

(c) No proceedings complying with the procedure laid down in sub-sections (1) and (2) shall be called in questions, in any court, on the ground that the principles of natural justice have not been complied with.

Power (sec 13):

(a) for the purpose of this section, the District Forum shall have the same powers as are vested in a Civil Court under the Code of Civil Procedure, 1908.

(b) Every proceeding before the District Forum shall be deemed to be a judicial proceeding within the meaning of sections 193 and 228 of the Indian Code (45 to 1860), and the District Forum shall be deemed to be a Civil Court for the purpose of section 195, and chapter XXVI of the Code of Criminal Procedure, 1973, (2, 1974).

Finding of the District Forums (Sec. 14 (1)): If, after the preceding, conducted under section 13, the District Forum is satisfied that the allegations about services are true or the loss is suffered by the complainant due to goods supplied to him, the forum shall issue an order to the opposite party directing him to do one or more of the following things, namely

(a) To remove the defects in goods;

(b) To replace the goods with new goods.

(c) To return the price to the complainant;

(d) To pay such amount as may be awarded by it as compensation;

(e) To remove the defects or deficiencies in the services;

(f) To discontinue the unfair trade or restrictive trade practice;

(g) Not to offer hazardous goods for sale;

(h) To withdraw the hazardous goods from being offered Or sale;

(i) To cease manufacture of hazardous goods and to desist from services.

(j) To pay such sum (minimum 5% of the value of goods sold) as may be determined by it, if it is of the opinion that loss or injury/ has been suffered by a large number of consumers who are not identifiable conveniently.

(k) To issue corrective advertisement to neutralize the effect of misleading advertisement at the cost of the opposite party;

(l) To Pay for adequate costs to parties,

Appeal (Sec. 15): The aggrieved party may appeal against the orders of District Forum to the State Commission within 30 days of the passing of the order. The State Commission has the power to entertain an appeal after the expiry of 30 days if it is satisfied that there was sufficient cause for delay. But for making an appeal to State Commission, the aggrieved party has to deposit 50% of that amount of Rs. 25,000, whichever is less, in a prescribed manner.

2. State Commission: The Act provides for the establishment of the State Consumer disputes Redressal Commission by the State Government in the State by notification:

Composition (Sec 16):

(a) A person who is or has been or has the qualification of a High Court Judge is appointed by the State Government in consultation with the Chief Justice of the High Court of the State, as its President [ (Sec. 16(a)).

(b) There will be two and other two members*including at least a woman member who are the persons of ability, integrity, and standing. Members should not be less than 35 years of age have a bachelor’s degree from a recognized university and should have at least 10 years of experience in dealing with problems relating to economics, law, commerce, accountancy, industry, public affairs as administration.

Every appointment under sub-section (1) of section 16 shall be made by the State Govt, on the recommendation of a selection committee consisting of the following members, namely:

- President of the State Commission – Chairman

- Secretary of the Law Department of the State – Member

- Secretary-in-Charge of the Department dealing with Consumer Affairs in the State – Member.

Every member of the State Commission shall hold office for a term of 5 years or up to the age of 67 years, whichever is earlier. He may be reappointed for 5 years if he fulfills other conditions (Sec. 16(3)).

Jurisdiction (Sec. 17): This section of the Act provides the jurisdiction of the commission as follows:

(a) The State Commission can entertain complaints where the value of goods or services and the compensation exceeds Rs. 20 lakhs but does not exceed Rs. 1 crore (Amended in 2002);

(b) The State Commission also has the jurisdiction to ‘entertain appeals’ against the orders of any District Forum within the state;

(c) The State Commission also has the power to call the record and pass appropriate orders.

Accordingly to Amendment, 2002, if the opposite party or parties (if these are more than one) actually and voluntarily resides or carries on business or has a branch office or personally works for gain at the t time of instituting the complaint, comes under the jurisdiction of State – Commission. If the opposite party or parties do not reside or carry on business or have a branch office or personally work for gain, but acquiesce in such institution, also comes under the jurisdiction of the commission.

Procedure Applicable for State Commission (Sec. 18): The Provisions of Sections 12, 13, and 14 and the rules made thereunder for the disposal of complaints by the Districts Forum shall, with such modification as may be necessary, be applicable to the disposal of disputes by the State Commission.

Vacancy in the office of the President (Sec. 18 A): This section has been omitted from the Act as per the amendment of 2002.

Appeals (Sec. 19): Any aggrieved person by an order made by the State Commission in the exercise of its power conferred by sub-clause

1. of clause (a) of Section 17 may prefer an appeal against such order to the National Commission within a period of 30 days from the date of the passing of the order in such form and manner as may be prescribed.

The National Commission may entertain an appeal after the expiry of the said period if it is satisfied that there was sufficient cause for not filing it within that period. As per Amendment Act, 2002 the National Commission shall not entertain the ‘Appeal’ unless the appellant has deposited in the prescribed manner 50% of the amount of Rs. 25,000 whichever is less.

Sec 19A(inserted in Amended Act, 2002) provides that an appeal filed before the State Commission or National Commission shall be f heard as expeditiously as possible and an endeavor shall be made to finally dispose of the appeal within a period of 90 days from the date of its admission.

3. National Commission (Sec. 20): Clause (c) of Sec. 9 provides for the establishment of the National Consumer Dispute Redressal Commission by the Central Government by giving notification in the Official Gazette.

Composition (Sec. 20):

(a) National Commission shall consist of a person who is or has been the judge of the Supreme Court, to be appointed by the Central Government (in consultation with the Chief Justice of India) who shall be its president.

(b) Not less than four iid, not more than such number of members as may be prescribed, one of whom shall be a woman, who shall have the following qualifications, namely;

- be not less than 35 years of age;

- possess a bachelor’s degree from a recognized university; and

- be persons of ability, integrity, and standing and have adequate knowledge and experience of at least 10 years in dealing with problems relating to Economics, Law, Commerce, Accountancy, Industry, Public affairs, or Administration.

Every appointment under this clause shall be made by the Central Government on the recommendation of a selection committee consisting of the following namely;

(a) a person who is a Judge of the Supreme Court, to be nominated by the Chief Justice of India- Chairman

(b) The Secretary of the Department of legal affairs in the Government of India – Member.

(c) Secretary of the Department dealing with consumer affairs in the Government of India – Member.

Every member of the National Commission shall hold office for a term of 5 years or up to the age, of 70 years, whichever is earlier. A member shall be eligible for reappointment for another term of 5 years if he satisfies the qualifications and other conditions for the appointment mentioned above.

Jurisdiction Sec 21 provides that the National Commission shall have jurisdiction

(a) To entertain complaints about the value exceeding Rs. 1 crore (as per Amended Act 2002);

(b) To entertain appeals against the orders of any State Commission;

(c) To call for the records and pass appropriate orders.

It is important to know that each hierarchy in the Act, is empowered to entertain a complaint by the consumer for the value of the goods or services and compensation. The word ‘compensation’ in the legal sense means suffering, insult, injury, or loss.

(a) Powers and Procedure Applicable to the National Commission (Sec. 22): Sec. 22 (I) provides that the provisions of sections 12, 13, and 14 and the rules made for district forum shall be available to the National Commission for the settlement of disputes.

(b) Review of orders Passed (Sec. 22 (2)): It provides that without prejudice to the provisions of sub-section (1), prove the National Commission shall have the power to review any order made by it when there is an error apparent on the face of the record.

(c) Power to set aside Orders (Sec. 22 (A)): It provides that where an order is passed by the National Commission ex-party against the opposite party, the aggrieved party may apply to the commission to set aside the said order in the interest of justice.

(d) Transfer of Cases (Sec. 22 B): The National Commission has the power of transferring the pending case from the District Forum of one state to a district forum of another state or before one state Commission to another state commission.

(e) Circuit Benches (Sec. 22C): The National Commission shall ordinarily function at New Delhi and perform its functions at such other place as the Central Government in consultation with the National Commission may notify in the Official Gazette from time to time.

(f) Vacancy in the office of the President (Sec. 22D): If the office of a resident of a District Forum, State Commission, or National Commission is vacant or the person occupying such post is absent or is unable to perform the duties, then the senior-most member will preside over the national commission.

Appeal (Sec. 23): This section provides that any person who is aggrieved by an order of the National Commission may appeal to the Supreme Court within a period of 30 days from the date of order. The Supreme Court may entertain an appeal after the expiry of the said period if it is satisfied that there was sufficient cause for delay, No appeal will be entertained by the Supreme Court unless that person has deposited 50% of that amount of Rs. 50000 whichever is less.

District Forum, the state commission, or the National Commission shall entertain the complaint if it is made within 2 years from the date on which the cause of. action arises. The District Forum, the State Commission, or the National Commission may entertain such complaints. if they are satisfied with the cause of the delay.